Do I Need A Business License To Sell Candles On Etsy?

Selling candles is a popular product category on Etsy, with many crafters and small business owners setting up their own candle shops. However, turning your candle-making hobby into a business on Etsy does require some preparation. One question that arises is whether you need a business license to sell candles through an Etsy shop. This article will provide an overview of the business licensing requirements and other considerations when starting a candle business on Etsy.

Readers who make and sell candles may wonder if simply setting up an Etsy shop is enough to legally sell candles as a business. Or are there additional registrations, permits, and licenses needed to operate legally and avoid penalties? We’ll clarify the business license rules and regulations specifically for selling candles on Etsy.

What is Etsy?

Etsy is an online marketplace focused on handmade, vintage, and craft supply items. According to Wikipedia, Etsy provides “a venue for entrepreneurs and small business owners to sell their crafts, art, vintage items and crafting supplies.” The company was founded in 2005 in Brooklyn, New York and has grown into a global marketplace with over 60 million items for sale.

Etsy operates as a fee-based platform that allows independent artists, crafters, and vintage sellers to set up virtual storefronts to market and sell their goods. Buyers can browse Etsy for handcrafted, custom, and unique items that are often not found in mainstream retail stores. Sellers pay small listing fees and a percentage of sales to Etsy. The company generates revenue through these seller fees as well as optional features like promoted listings.

Overall, Etsy serves as an online marketplace and community focused on promoting independent, creative businesses and craftspeople. The platform allows artisans and vintage sellers to reach a large market of buyers seeking specialty, handmade, and unique items.

Do you need a business license to sell on Etsy?

Whether you need a business license to sell on Etsy depends on your state and local laws. Etsy itself does not require sellers to obtain a business license in order to sell on its platform. However, many states and municipalities do require business licenses for individuals conducting retail sales and earning income from those sales.

In general, if your Etsy shop is a hobby or side business earning less than a certain revenue threshold, you may not need a license. But if you are operating your Etsy shop as a larger business, you will likely need to register it and obtain any required state and local licenses. Requirements vary widely based on location.

For example, in California, you need a seller’s permit if your sales exceed $500 in a 12-month period. Other states have higher thresholds, like $5,000 in Arizona and $12,000 in Oregon. Some states like Delaware and Montana do not require any general business license. Check with your Secretary of State’s office to understand requirements in your state.

At the local level, many cities and counties also require business licenses to conduct retail sales. Fees range from $25-$100+ annually. Be sure to research what is needed based on the specific location where you live and work.

While Etsy does not mandate licensing, being properly registered and licensed can provide important legal protections and legitimacy for your business. It shows you are operating above board and gives customers confidence when buying from your shop.

Selling candles specifically

When it comes to regulations around candle-making, there are some important fire safety laws and guidelines to be aware of. According to the National Fire Protection Association (NFPA), candles should only be made from materials that are intended for candle-making, like wax and proper wicks [1]. Things like crayons or glue should not be used.

The NFPA also advises following proper candle-making procedures and allowing adequate drying time before burning. There are guidelines around wick length and placement within the candle too. Using the right materials and methods can help prevent issues like tunneling, sooting, and flaming [2].

When it comes to selling, the Consumer Product Safety Commission requires labeling candles with the company name and warnings about burning hazards. Proper warning labels are essential for safety.

While regulations around candle-making are mostly voluntary safety standards, its important to follow fire safety laws and best practices. This helps protect yourself and consumers when selling homemade candles.

Registering your business

There is a difference between obtaining a business license and registering your business. Registering your business simply means designating it as a formal business entity, such as a sole proprietorship, partnership, LLC or corporation. This provides some legal protections by separating your personal and business assets. However, registration alone does not allow you to operate legally or provide any special permissions.[1]

Registering your Etsy business protects your personal assets if your business is sued. It also makes your business seem more legitimate to customers. However, it does not remove the requirement of obtaining licenses or permits that may be needed to operate legally. Those are covered by a business license.

So in summary, registering your Etsy business provides asset protection but does not grant you the legal permission to operate. You still need to look into whether your type of business requires a license based on state and local regulations.[2]

[1] https://www.findlaw.com/smallbusiness/starting-a-business/do-you-need-a-business-license-to-sell-on-etsy-.html

[2] https://sellbery.com/blog/do-you-need-a-business-license-to-sell-on-etsy-all-you-need-to-know/

Sales tax requirements

When selling on Etsy, sales tax collection and remittance to states is handled by Etsy for qualifying states and orders per Etsy’s tax policy. As outlined in Etsy’s help article, Etsy automatically calculates, collects, and remits state sales tax on orders shipped to states where Etsy is registered as a marketplace facilitator.

However, sellers are still responsible for registering, collecting, reporting, and remitting any applicable state and local sales taxes in the states where they have a physical presence or “nexus.” This means sellers must understand sales tax obligations in states where they live or have any facilities, employees, inventory, or other business activities. Sellers should consult a tax professional to ensure proper compliance.

Additional licenses

When selling candles, especially edible or scented candles, you may need additional licenses beyond just a general business license. Here are some to consider:

If you are selling candles that are meant to be consumed or eaten, such as gel candles, you will likely need a food handling license. This applies to any candle ingredients that could be ingested. Check your state’s cottage food laws to determine if a license is needed.

Some states have laws regarding flammable materials handling that require permits or licenses for certain quantities of flammable liquids, solids, or gases. Since candles contain wax and fragrance oils, check if your candle business is subject to any flammable materials regulations.

If operating on a small scale or as a cottage industry, be aware of any cottage food laws that provide exemptions for licensing requirements for home-based businesses. However, there may still be restrictions regarding storage, prep, and sales.

Insurance considerations

As a home-based Etsy business selling candles, it’s important to consider liability insurance to protect yourself in case a customer gets injured using your product. According to Etsy Sellers Insurance: Everything You Need to Know, while Etsy doesn’t require sellers to carry insurance, it’s highly recommended to have coverage in place.

A product liability insurance policy can provide protection if a customer were to suffer bodily injury or property damage from a defective candle. Policies can cover the legal costs if you need to defend yourself in court as well as any judgement up to the policy limits.

As a home-based business, a homeowners or renters policy may not provide adequate coverage for product liability claims. Getting a separate policy tailored to Etsy sellers can help ensure you have sufficient coverage for your specific business operations and risks.

Having insurance gives both you and your customers peace of mind. It shows you are a professional, legitimate business that stands behind its products.

Record-keeping

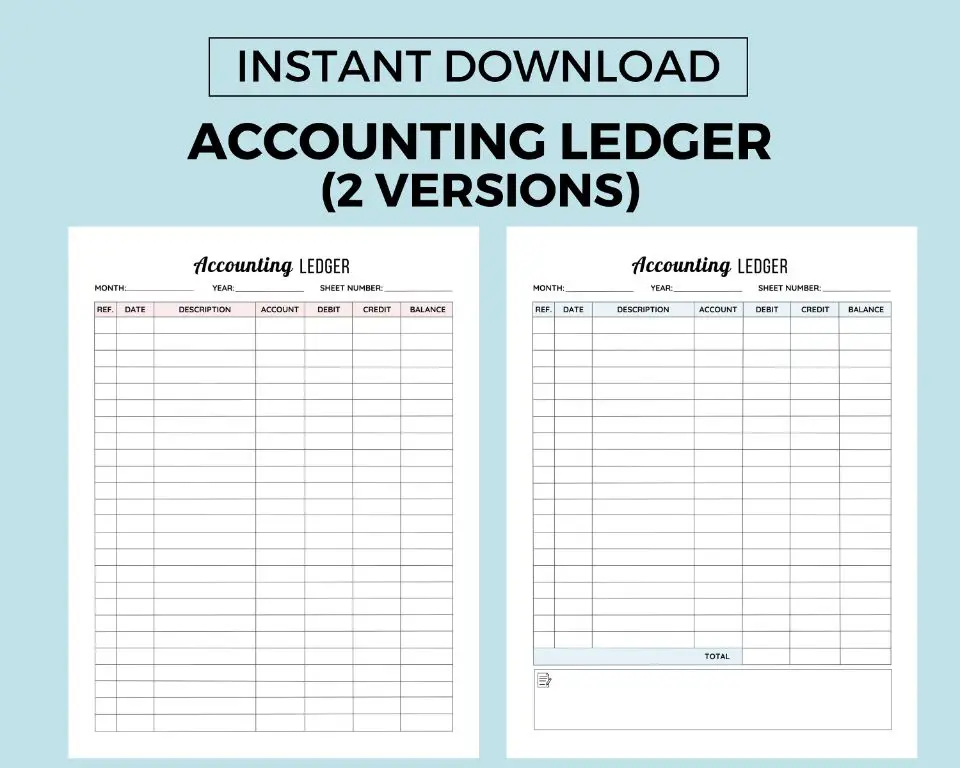

Proper record-keeping is crucial for Etsy sellers to track business expenses and have the necessary documentation for tax purposes. There are a few key things sellers should keep in mind:

First, make sure to track all business expenses related to your Etsy shop and save receipts. This includes costs for materials, packaging and shipping, fees paid to Etsy, advertising, office supplies, and any other business expenses. Using bookkeeping software like QuickBooks (Source) can help organize and categorize these expenses.

Second, keep detailed records of all sales and income from your Etsy shop. When an order is placed, be sure to log the order details including date, items purchased, quantities, pricing, shipping, and any transaction fees paid. Services like Made on the Common offer templates to easily record Etsy sales.

Saving receipts and maintaining thorough records makes tax time much easier. These records help calculate deductible business expenses to lower your taxable income. Failing to keep proper documentation can lead to problems and penalties when filing taxes, so organized record-keeping is essential.

Summary

When selling candles or any handmade goods on Etsy, there are a few key licenses, permits, and legal considerations to keep in mind:

– While you don’t need a formal business license just to sell on Etsy, you will likely need to register your business name and get a seller’s permit or sales tax license. This allows you to collect sales tax from customers and pay it to the state.

– Depending on your state and location, you may need additional permits related to production and facilities. For example, if you’re making candles at home, you may need a cottage food operation permit.

– Liability insurance can protect you in case a customer gets injured from your product. Product liability insurance is recommended for handmade goods sellers.

– Keep detailed records of your income, expenses, product information, and sales documents. This helps you pay taxes properly and comply with regulations.

– Be sure to research the specific requirements in your state and locality when starting a small business. The rules can vary widely across different cities, counties, and states.

– Helpful online resources like the SBA.gov learning center and SCORE.org provide guidance on licensing and legal issues for small businesses selling online.

With some upfront research and preparation, you can feel confident that your handmade candle business on Etsy meets local laws and regulations.