How Much Candles Are Exported From India?

India has a long history of candle making, with traditional methods of candle production dating back thousands of years. Candles are used for religious rituals, decorative lighting, and gifting in Indian culture. While most candle production was initially focused on domestic consumption, exports of Indian candles have steadily grown over the past few decades.

According to trade data from The Observatory of Economic Complexity, India exported around $89 million worth of candles in 2021, making it the 12th largest candle exporter globally. The main types of candles exported include pillar candles, votive candles, tea lights, scented candles, and colored and decorated candles. They are made from paraffin wax, soy wax, beeswax, and palm wax.

The top destinations for candle exports from India are the United States, the United Kingdom, Germany, Netherlands, and Canada. Indian candle manufacturers have invested in quality improvements and design innovations to meet international standards and compete in foreign markets. Going forward, industry associations project continued growth in exports supported by government schemes that promote small manufacturers.

History of Candle Making in India

Candle making in India dates back thousands of years. The earliest candles were made from bee wax and vegetable oils like sesame oil, which were readily available commodities. Candles were crucial for lighting in ancient times before electricity.

Early candle making techniques involved repeatedly dipping a wick into melted wax or fat. This dipping method allowed candles to be formed around the wick.

Candle making was traditionally a cottage industry in India, with families involved in making candles by hand using simple tools and molds. Techniques were passed down through generations. Casting candles in molds became popular in the 18th century.

Candle making has always been an important craft in India, illuminated homes and places of worship for centuries. Traditional handmade candle methods are still practiced today, although modern manufacturing processes are now widely used. The history of candle making in India has evolved remarkably from ancient times to meet contemporary demands.

Major Candle Production Hubs in India

Some of the major candle production hubs in India include:

- Mumbai, Maharashtra – Mumbai is one of the top candle manufacturing centers in India with over 200 candle manufacturers. Major companies like Prem Oil Company and Shri Ram Sons Wax are based in Mumbai.

- Delhi NCR – Areas like Noida, Greater Noida and Gurugram in Delhi NCR region have a high concentration of candle makers. Key manufacturers include Candleworks and Root Candles.

- Ahmedabad, Gujarat – Ahmedabad is a key production hub especially for scented candles. Leading companies like CandlesCube and Bella Vita Candles have manufacturing units in Ahmedabad.

- Bengaluru, Karnataka – Bengaluru is an emerging candle production center with manufacturers like Joyous Beam Candles, 470 Degrees Candle Co. among others.

- Indore, Madhya Pradesh – Indore is known for producing organic and soy candles. Prominent companies include Rad Living and The Maeve Store.

Other candle making clusters are found in Tamil Nadu, Uttar Pradesh, Rajasthan and West Bengal.

Types of Candles Exported

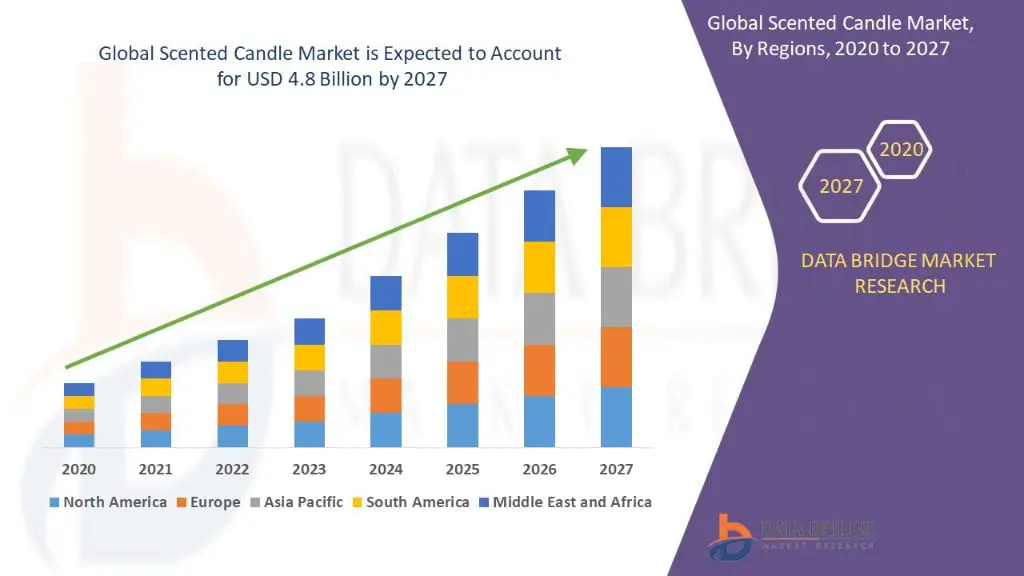

India exports a wide variety of candles including paraffin, soy, gel, and scented candles. Paraffin candles are the most common and make up the majority of candle exports. These are made from paraffin wax derived from petroleum. Soy candles are made from soybean oil and are becoming more popular as an eco-friendly alternative to paraffin. Gel candles contain a clear gel instead of wax and provide vibrant colors and scents. Scented candles have added perfumes and essential oils and are used to create pleasing aromas. Popular scents include floral, fruit, spice, and seasonal scents. Scented candles are one of the fastest growing candle export segments. According to Volza, scented candle exports from India stood at 18.7K units in 2022, exported by 267 exporters.1 Other specialty candle varieties exported include tealight candles, votive candles, pillar candles, floating candles, and decorated candles.

Major Export Destinations

According to the Observatory of Economic Complexity, in 2021, India exported $89.3M in candles. The main destinations for Indian candle exports were:

United States – India exported $50.2M worth of candles to the US, accounting for around 55% of total Indian candle exports (Source).

United Kingdom – India exported $19.3M in candles to the UK, making up 18.4% of candle exports (Source).

Australia – Australia imported $5.83M in candles from India in 2021 (Source).

Other major destinations include Germany, Netherlands, France, Canada, Spain, and Italy. The US and UK remain the top two export markets for Indian candles.

Candle Export Value and Volume

India exported over $89 million worth of candles in 2021, making it the 12th largest exporter of candles globally (OEC). The total quantity of candle exports was around 9,000 tonnes.

Candles accounted for 0.017% of India’s total global exports in 2021, with a trade value of $89.3 million (Trendeconomy). The main export markets for Indian candles are the United States, the United Kingdom, Germany, Canada and Australia.

Candle exports from India have seen steady growth over the past decade, with the trade value growing at an average annual rate of 4.5% between 2011-2021. The total export quantity increased from around 5,500 tonnes in 2011 to over 9,000 tonnes in 2021.

Growth Trends

The candle export industry in India has seen steady growth over the past decade. According to The Observatory of Economic Complexity, the total export value of candles from India in 2021 was $89.3 million, up from $73.6 million in 2020. This represents a growth of around 21% year-over-year.

Looking further back, candle exports from India have grown at a compound annual growth rate (CAGR) of around 9% between 2011-2021. In 2011, the total export value of candles was $47.8 million. The consistent growth demonstrates the strength of the Indian candle export industry and its ability to expand to meet international demand.

Some key factors driving the export growth trends include rising demand from international markets like the United States, Europe, and the Middle East, increasing production capabilities of Indian manufacturers, and competitive labor and raw material costs that allow exporters to price their candles attractively in foreign markets.

With candle making being an important cottage industry in some parts of India, the growth in exports also supports rural employment and economic development. If current trends continue, the outlook for future growth of India’s candle exports seems positive.

Major Exporters

India has several leading companies that export candles globally. Some of the top exporters include:

Shri Ram Sons Wax Pvt. Ltd – One of the largest manufacturers and exporters of candles in India, exporting to over 60 countries. The company offers a wide range of wax and non-wax candles. Source

CandlesCube – A major exporter of decorative and scented candles to countries like the USA, UK, Australia, Germany, etc. The company offers soy wax candles, gel wax candles, crystal candles, and more. Source

Global Glory – Exports painted and lacquered candles to Europe, Australia, the Middle East, and Africa. The company offers pillar candles, votives, tea lights, container candles, etc. Source

Prem Oil Company – A leading manufacturer and exporter of paraffin wax candles to markets like the USA, UK, Australia, Europe, Canada, etc. The company offers candles in various shapes, sizes, and designs.

Other major exporters include Wax Melts, BK Exports, Shree Ambey Shakti, etc. These companies export candles of different types including paraffin, gel, soy, and beeswax to diverse global markets.

Challenges

The candle export industry in India faces several challenges that hamper growth. One major issue is the rising cost of raw materials like paraffin wax, stearic acid, fragrance oils, and dyes (Ankita Relan, 2022). With the increase in crude oil prices globally, the cost of paraffin wax derived from petroleum has increased significantly in recent years. This has led to higher production costs for candle manufacturers in India (Source).

Another challenge is competition from countries like China and Vietnam which can produce candles at lower costs. The large-scale production capacities in these countries allow them to export candles at cheaper rates than Indian manufacturers (Source). The Indian industry has demanded anti-dumping duties on cheap imports from these countries.

Compliance with regulations in export destinations like the EU and US in terms of candle testing and chemical usage has also emerged as a hurdle for small and medium exporters. The stringent norms require investment in testing facilities which raises overhead costs for manufacturers (Source).

Future Outlook

The future outlook for India’s candle exports looks promising, with exports projected to continue growing steadily over the next several years. According to Statista, the overall candle market in India is expected to grow by 4.81% between 2024-2028, reaching a value of US$377.40 million by 2028. Similarly, Statista predicts the candle export market will expand by 7.73% during that same time period, resulting in candle export volume reaching US$62.02 million by 2028.

Several factors are contributing to the positive forecast for India’s candle exports. The global demand for candles is on the rise, driven by increasing consumer interest in home decor, aromatherapy, and eco-friendly products. India’s low-cost manufacturing gives it a competitive advantage in meeting this demand through candle exports. Additionally, Indian candle exporters are expanding their reach into new international markets, especially in Europe and North America. The depreciating rupee against the US dollar further incentivizes exports.

However, India’s candle export industry also faces some challenges ahead. Rising costs of wax and other raw materials may dampen export competitiveness. Exporters need to focus on enhancing product quality and branding to compete with cheaper imports flooding the Indian market. Adherence to international safety and quality standards is critical for accessing regulated markets abroad. Overall, adapting to trends and forging partnerships in target export markets will be key to the future success of India’s candle exports.