What Should I Do If I’Ve Been Charged Twice?

Check Your Bank Statement

The first step is to carefully review your recent bank and credit card statements to identify any duplicate charges. Look for matching amounts charged on the same day or within a few days of each other. According to a CFPB report, credit card companies charged consumers over $130 billion in interest and fees in 2022, so it’s important to monitor statements for erroneous fees.

Go through each charge since the duplicate transaction and confirm you made each purchase only once. Pay particular attention to charges made in the few days surrounding the duplicate charge, as those are most likely to be incorrect repeats. If you find any duplicate charges, circle or highlight them on your statement so you can reference them when disputing the charges.

Keeping a close eye on your statements is the best way to catch duplicate charges quickly. Get in the habit of reviewing charges regularly rather than waiting until your due date. The sooner you identify duplicate transactions, the easier it will be to have them removed by your bank or credit card company.

Contact the Merchant

The first step you should take if you’ve been charged twice is to contact the merchant directly. Call or email their customer service team and explain that you were charged twice for the same transaction. Provide details like the amount, date, and receipt number if available.

Politely request that the merchant issue a refund for the duplicate charge. Many reputable companies will gladly fix errors like double charges if the customer reaches out. Keep records of who you spoke with and when.

If communicating over email, follow up if you don’t receive a response within a few business days. Be persistent yet patient as merchants are often dealing with high volumes of inquiries.

According to Chargeback Gurus, contacting the merchant directly is the quickest way to get your money back from a double charge. If the merchant refuses to issue a refund or does not respond, you can take further steps like disputing the charge with your bank.

Dispute the Charge

If you see an unauthorized or incorrect charge on your credit card statement, you should dispute it with your credit card company as soon as possible. According to Investopedia, you typically have 60 days from the statement date to dispute a charge, though policies can vary by issuer.

To file a dispute, call the number on the back of your credit card and explain that you want to dispute a charge. The credit card company will provide instructions on how to proceed. You may need to provide documentation, like receipts showing you only made one purchase or bank records proving two charges were processed.

According to Bank of America, key details to have ready when disputing the charge include:

- The date, amount, and name of the unauthorized charge

- Why you believe it’s an error

- The steps you’ve taken to resolve it with the merchant

The credit card company will investigate and may ask for additional information. If they rule in your favor, the charge amount will be credited back to your account. It’s important to monitor your account and follow up if the dispute isn’t resolved promptly and accurately.

Monitor Your Account

It’s important to continue monitoring your account even after you’ve reported the duplicate charge. Watch for a credit to appear from the merchant reversing the duplicate charge. Make sure the credit matches the amount of the extra charge. Contact the merchant again if the credit is missing or incomplete.

Also keep an eye on the dispute process through your bank, if you filed one. Confirm when the dispute case is resolved and the credit is applied to your account. Disputes can take some time to investigate, so keep checking your account periodically.

And scan your statements thoroughly for any additional duplicate charges. Sometimes errors can happen more than once. By carefully monitoring your account transactions for the next billing cycle or two, you can catch any other duplicate charges quickly and dispute them.

Adjust Autopay Settings

If you’ve been double charged while using autopay, it’s a good idea to review your autopay authorizations and update your payment information if needed. Here are some tips:

Review any recurring payments or subscriptions set to autopay from your bank account or credit card, and cancel any you no longer use or need. This will help prevent unwanted charges in the future. According to the Consumer Financial Protection Bureau, you have the right to stop automatic payments from your bank account by notifying the company and your bank before the scheduled payment date (1).

If you believe your payment information has been compromised, update your autopay details right away. Getting a new debit card or credit card number can ensure charges stop hitting your old compromised accounts (2).

Consider setting up payment reminders through your bank or card issuer so you remember when automatic payments will be taken out. This allows you to verify the amount ahead of time (3).

Adjusting your autopay settings provides more control and visibility into recurring payments hitting your accounts. Carefully monitoring autopay authorizations can help prevent unwanted double charges.

Enable Account Alerts

One of the best ways to monitor your account for fraudulent or duplicate charges is to set up account alerts. Most banks and credit card companies offer the option to enable alerts that notify you when certain account activity occurs.

For example, you can set up text or email alerts to notify you anytime a charge exceeds a threshold you specify, such as $50. That way, you will be notified immediately if there are any unusually large charges on your account.

According to Visa, you can set up real-time purchase alerts on your Visa account to get notifications when transactions occur[1]. With alerts enabled, you don’t have to constantly log in to check your account activity.

NerdWallet recommends setting up an alert if your balance goes above zero, so you know right away if an improper charge occurs[2]. Most banks and card issuers allow you to customize alerts based on your own thresholds and preferences.

Turning on real-time purchase notifications can help you identify duplicate charges quickly before they cause major issues. Activating alerts is usually simple within your account settings or app.

Check Your Statements

One of the first things to do if you’ve been double charged is to carefully review your bank and credit card statements. Experts recommend checking your statements at least once a month to catch any errors or fraudulent charges quickly. Look through each transaction to ensure there are no duplicates (small amounts can be easy to miss). Reviewing statements regularly allows you to dispute unauthorized charges promptly before they negatively impact your finances.

The HOA Management Solutions article “HOA Bank Reconciliation: What to Look for and Why it’s Important” states that HOA board members should receive monthly bank statements and reconcile them with the HOA’s records to identify discrepancies. They recommend noting any duplicate charges or accounting errors right away.

Use Credit vs Debit

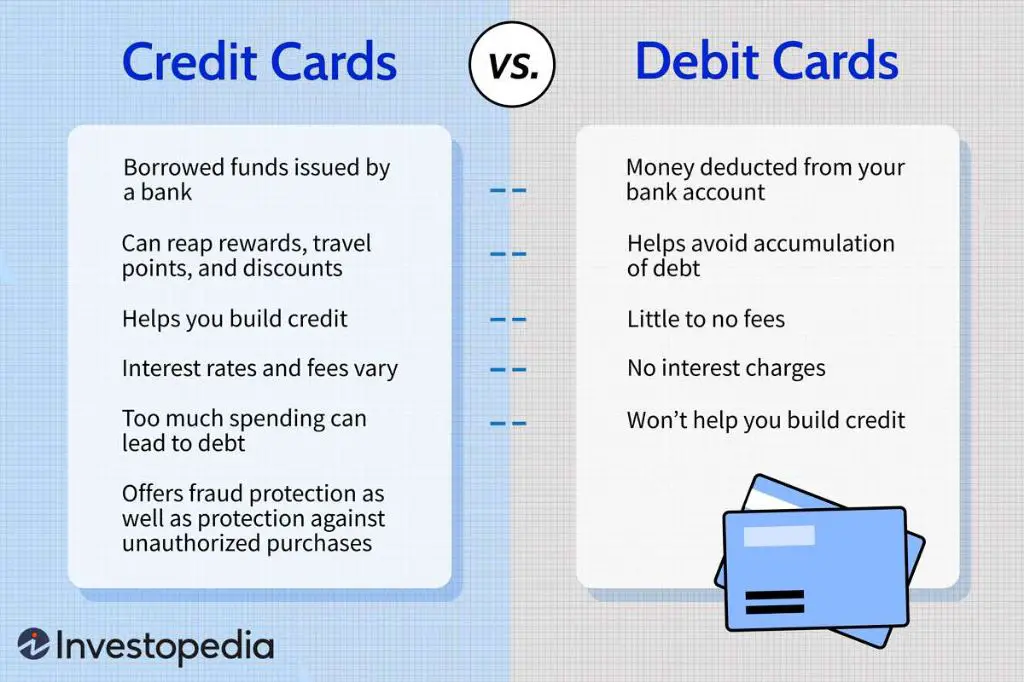

When it comes to financial security, credit cards tend to offer more protections against fraud than debit cards. According to NerdWallet, credit cards provide greater legal protections against fraudulent charges.

If you notice an unauthorized charge on your credit card statement, you can dispute it with your credit card provider. They are required by federal law to investigate disputed charges. During this investigation, you will not be held liable for any fraudulent charges. With a debit card, the money is immediately deducted from your bank account and it can be more difficult to get those funds returned while disputed transactions are investigated.

Additionally, if your credit card is lost or stolen, you can request to temporarily freeze the account to prevent any unauthorized transactions. With a debit card, you would need to completely cancel it and wait for a replacement card to be issued. For these reasons, using a credit card can give you more control and security if you ever need to dispute a charge or report a lost card.

Change Passwords

You should update your passwords regularly to lower the risk of a hacker gaining access to your accounts. Many security experts recommend changing passwords every 60-90 days as a best practice (McAfee, Kaspersky). While there is some debate on optimal password update frequency, changing passwords periodically limits the window of opportunity for hackers and can minimize potential damage (PCMag).

In addition to updating passwords regularly, it’s critical to use unique, complex passwords for each of your important online accounts. Having different passwords across accounts helps contain the damage if one account is compromised. Strong, unique passwords also make it much harder for hackers to gain access in the first place.

Monitor Your Credit

It’s a good idea to check your credit reports regularly for any unusual activity that could indicate identity theft or fraud. The Federal Trade Commission recommends checking your reports at least once a year. You can get free copies of your credit reports from AnnualCreditReport.com (https://consumer.ftc.gov/articles/free-credit-reports).

When reviewing your credit reports, look for accounts or charges you don’t recognize, inquiries from companies you haven’t contacted, and other signs of potential identity theft. If you spot any suspicious activity, contact the credit bureaus right away to place a fraud alert on your account.

Monitoring your credit reports regularly makes it easier to catch errors and fraud before they spiral out of control. Be proactive about checking your credit reports and taking steps to protect your identity.