What Is The Burn Rate Formula?

What is Burn Rate?

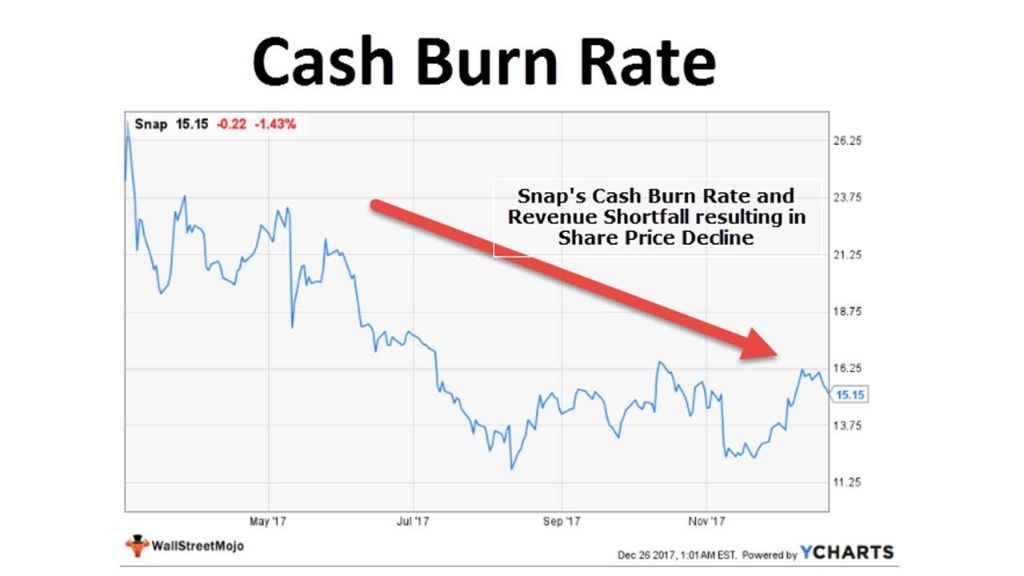

Burn rate refers to the rate at which a company spends its venture capital to finance overhead before generating positive cash flow. It is a measure of a company’s monthly operating expenses and cash outflows.[1]

In simple terms, burn rate calculates how fast a company is burning through its cash reserves. It represents the amount of capital a company spends to keep operating each month as it works towards profitability and scaling up its business model.

The definition of burn rate focuses on how quickly a startup or new business is using up its available cash to cover operating costs. This spending can include salaries, office rent, marketing, production expenses, and any other recurring monthly costs.

Measuring burn rate provides startups and investors with crucial visibility into how long existing funding will last before the company needs to secure additional financing. Tracking burn rate over time shows whether a company’s financial strategy and spending habits are sustainable or need adjustment.

Importance of Calculating Burn Rate

The burn rate is a critical metric for investors to understand the financial health and sustainability of a startup or business. Calculating the burn rate helps investors determine how long a company’s funding will last before additional capital is required. This metric essentially measures how efficiently a business is utilizing its capital and resources.

Investors want to know the burn rate because it shows whether a business is on track or potentially heading towards a cash crisis. A high burn rate could indicate excessive spending, poor budgeting, or lack of revenue generation. It raises concerns that the company may rapidly burn through its cash reserves and require emergency investments just to stay afloat. On the other hand, a lower burn rate suggests capital is being used judiciously to drive growth.

The burn rate directly impacts the fundraising strategy and capital raising timelines. Founders need to understand their monthly spending and cash outflow to realistically determine their runway until the next funding round. A longer runway means more time to hit milestones and boost valuation before seeking fresh investor capital. However, an excessively high burn rate shortens the runway and requires urgent capital infusion just to stay solvent. This weakens the company’s position during investment negotiations.

In summary, calculating the burn rate provides visibility into a company’s financial health. It enables founders and investors to better plan budgets, spending levels, and fundraising timelines.

The Burn Rate Formula

The burn rate formula is used to calculate a company’s monthly burn rate, which is the rate at which a company is spending its capital to finance overhead before generating positive cash flow. The formula is:

Monthly Burn Rate = (Beginning Monthly Cash Balance – Ending Monthly Cash Balance) / Number of Months

Where:

- Beginning Monthly Cash Balance is the cash available at the start of the month

- Ending Monthly Cash Balance is the cash available at the end of the month

- Number of Months is usually 1, for a monthly calculation

To calculate monthly burn rate using this formula:

- Take the cash balance available at the start of the month

- Subtract the cash balance remaining at the end of the month

- Divide the result by the number of months elapsed, usually 1 month

The resulting number is the average monthly burn rate – the amount of cash used per month to finance overhead and operating expenses before generating revenue. Companies monitor their burn rate to ensure they have sufficient cash runway to last until projected profitability.

Average Monthly Burn Rate Example

Let’s look at an example of calculating average monthly burn rate for a fictional startup company called Brightly. Brightly has $1,000,000 in seed funding and plans to spend this over the next 12 months to develop their first product.

Over the last 3 months, Brightly has spent the following:

- January: $80,000 on engineering salaries and cloud hosting fees

- February: $75,000 on engineering, marketing salaries, ads

- March: $90,000 on engineering, sales salaries, tradeshows

To calculate their average monthly burn rate, we add up their total expenses over the 3 month period ($80,000 + $75,000 + $90,000 = $245,000). Then we divide the total spend by the number of months (3) to get the average monthly spend of $81,667.

This means Brightly has an average monthly burn rate of $81,667. Over 12 months, they will spend $980,004 based on this burn rate. This is close to their $1 million in seed funding, so their spending trajectory seems aligned with their funding.

Monitoring burn rate monthly helps companies ensure they have enough funding to last until their next milestone or funding event. It also helps them adjust spending if needed to extend their runway.

Costs Included in Burn Rate

A company’s burn rate typically includes all the key operating costs required to run the business on a monthly basis. Some of the most common expenses to factor into burn rate calculations include:

- Payroll expenses like salaries, wages, and benefits for employees

- Facilities costs such as rent, utilities, maintenance, and other overhead for office space and warehouses

- Equipment costs for purchasing, leasing, or maintaining necessary equipment

- Marketing and advertising expenses for promotional campaigns and materials

- Research and development costs for any projects or testing

- Administrative costs including legal, accounting, insurance, subscriptions, software, etc.

- Manufacturing and production costs for inventory and goods sold

- Any other major operating expenses unique to that business

The key is to incorporate all fundamental operating costs so you can accurately monitor the company’s spending rate month-to-month. Non-operating costs like interest, taxes, and one-time capital expenditures are usually not factored into burn rate.

Factors that Influence Burn Rate

There are several key factors that can impact a company’s burn rate:

The stage of the company – Early stage startups tend to have a higher burn rate as they are developing products and acquiring customers. As companies mature, burn rates tend to decrease.

Hiring plans – Ramping up headcount can significantly increase burn rate due to higher payroll expenses. Companies that are aggressively hiring will likely experience a higher burn rate.

Industry – Some industries like biotech and hardware require more upfront R&D spending which leads to higher burn rates. Other industries like software can scale faster with less upfront costs.

Business model – Subscription, licensing, and other recurring revenue models allow companies to cover costs earlier, reducing burn rate. Non-recurring models require more spending before revenue is generated.

Geographic expansion – Opening new offices and expanding into new markets increases costs and burn rate. Maintaining operations in a single region early on allows for lower burn.

Marketing and sales spend – Investing heavily in marketing and sales activities will directly increase burn rate. Minimizing these expenses can help reduce burn, but may slow growth.

According to research by Springer, the company’s stage of development and hiring plans have the most significant impact on burn rate. Companies should closely monitor these factors and adjust spending as needed to maintain a healthy burn rate.

Best Practices for Managing Burn Rate

There are several effective ways to optimize and reduce your company’s burn rate:

- Closely monitor spending and cut unnecessary costs – Review expenditures regularly to identify areas where you can reduce spending, such as software subscriptions, office perks, overstaffing, etc. Prioritize essential costs.

- Extend your runway – Consider ways to extend your runway like raising more capital or generating revenue earlier to ensure your funding lasts longer.

- Set burn rate targets – Establish ideal burn rate benchmarks and targets to aim for each month/quarter. Track progress to goals.

- Improve gross margins – Focus on tactics to increase revenue while decreasing COGS to improve gross margins. This increases the efficiency of spending.

- Outline an achievable roadmap – Create a focused, realistic product roadmap and milestones to work towards iteratively. Prioritize must-have features.

- Leverage partnerships – Partnerships can provide resources, distribution channels and other assets to reduce costs of certain business activities.

- Build a frugal culture – Foster an environment focused on spending wisely and getting the highest return on investment from resources.

Taking steps to optimize burn rate ensures you maximize your runway and spend efficiently. Monitor burn rate regularly and adjust tactics as needed. With careful planning, startups can achieve growth efficiently.

Burn Rate vs. Runway

While burn rate and runway are related metrics, they measure different things. Burn rate is the rate at which a company spends its cash reserves over time, often calculated monthly or annually. It measures how fast a company is consuming its cash. Runway, on the other hand, is the amount of time a company’s current cash reserves will last given the current burn rate. It measures how long a company has before it runs out of cash.

The key difference is that burn rate is a speed (e.g. $50,000 per month) while runway is a time duration (e.g. 6 months). A high burn rate will lead to a shorter runway, while a lower burn rate will extend the runway. For example, Company A spending $100,000 per month with $600,000 in cash reserves has a 6 month runway. Company B spending $50,000 per month with the same $600,000 in reserves has a 12 month runway. Company B has the superior burn rate and runway.

Startup companies closely monitor both burn rate and runway since they have limited cash reserves. Most want to achieve an optimal balance – spending enough to fuel growth while preserving adequate runway to reach milestones. Controlling burn rate is crucial for extending the runway and allowing more time to hit growth targets before seeking new funding. Tracking both metrics helps executives understand their capital efficiency and make better spending and budgeting decisions.

Monitoring and Adjusting Burn Rate

Monitoring burn rate is crucial to avoid financial crises and maintain the financial health of a startup. Regularly tracking burn rate allows founders to foresee potential cash flow issues and make proactive adjustments when necessary. Experts recommend calculating your startup’s burn rate at least monthly, if not more frequently.

If your burn rate is too high based on your current runway goals, there are several levers you can pull to bring it down:

- Reduce staffing costs by eliminating non-essential roles or decreasing salary/benefits

- Cut down on operating costs like office space, software, equipment, etc.

- Minimize marketing and growth experiments that are not producing results

- Renegotiate vendor and contractor fees to bring down costs

- Extend the runway by raising more capital from investors

The key is closely tracking your burn and being agile in making financial adjustments so you don’t run out of cash before hitting key milestones. Frequent forecasting and burn rate analysis should inform cost-saving decisions and prevent potentially disastrous financial situations. As the saying goes: “Cash is king.”

Source: https://elilogan.com/decoding-startup-burn-rate-cash-flow-a-comprehensive-guide/

Burn Rate Metrics and Benchmarks

Burn rate varies significantly across industries and stages of a company’s growth. According to one source, the average burn rate for early stage startups is around $10,000 per month, while more mature startups may burn $60,000 or more per month (https://www.zeni.ai/blog/average-burn-rate-for-startups). However, every company is different so benchmarks provide only rough guidance.

According to ISS, a leading proxy advisory firm, the minimum burn rate benchmark across indices and industry groups is around 2.00% (https://humancapital.aon.com/insights/articles/2022/iss-makes-equity-burn-rate-changes-for-2022-and-beyond). Companies are scored based on how their burn rate compares to ISS benchmarks for their industry. Those with burn rates at 50% or less of the benchmark receive full credit. Higher burn rates receive proportional deductions.

These ISS burn rate benchmarks provide standardized metrics companies can use to gauge the efficiency of their equity programs. Tracking burn rate against industry benchmarks allows companies to monitor whether their equity spend is excessive and make adjustments as needed.