Will Insurance Cover A Fire Started By A Candle?

Can Insurance Really Cover Damage From Candle Fires?

Many people believe that insurance policies will not cover damage caused by fires started by candles. After all, lighting candles in your home introduces an obvious fire hazard. It may seem like common sense that insurance companies would refuse to pay out claims for fires started negligently by the policyholder themselves.

However, the truth is more nuanced. In many cases, home insurance policies will provide coverage for fires begun by unattended or abandoned candles. The specifics depend on the type of policy, limits, and deductibles. With proper precautions, candle enthusiasts can reduce their fire risks while still retaining insurance protection.

Types of Insurance Policies

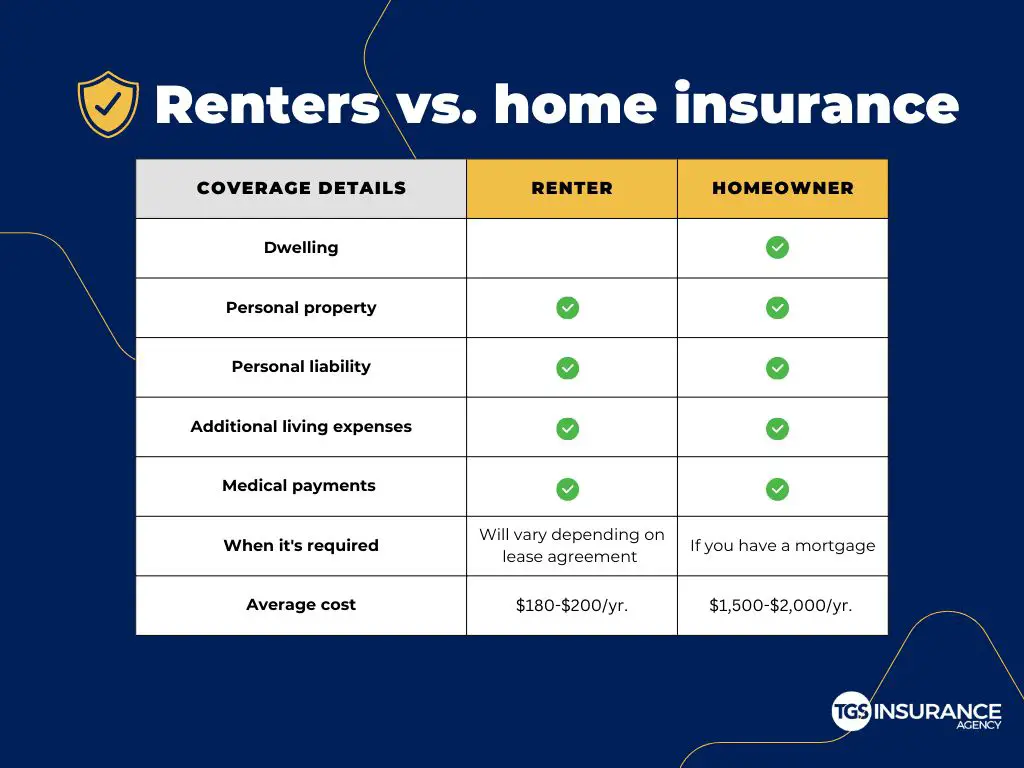

The two main types of insurance policies that cover property damage from fires started by candles are homeowners insurance and renters insurance. Homeowners insurance covers the dwelling itself and structures on the property, while renters insurance covers your personal belongings inside the rented dwelling [1].

Homeowners insurance protects the physical structure of your home and other structures on your property in the event of damage. This includes coverage for fire damage. Renters insurance covers your personal belongings as a tenant if they are damaged or stolen. This also includes damage from fires [2].

The key difference is that homeowners insurance covers the physical dwelling you own, while renters insurance covers your possessions as a renter inside someone else’s property [3]. Both policies can provide coverage for fires caused by candles, but homeowners insurance would repair the structure while renters would replace damaged personal items.

Standard Coverage

Most basic home insurance policies provide some coverage for fire damage, even if the fire was caused accidentally. According to the Insurance Information Institute, fire damage makes up over 40% of homeowners insurance claims and is one of the most common reasons people file claims.

Standard homeowners insurance will typically cover the cost to repair or rebuild your home if it is damaged by fire. It will also cover other structures on your property like garages, sheds, and fences. Additionally, your belongings are covered up to your policy’s personal property limits. There are some limits though – standard coverage will usually only pay the depreciated value for belongings, not the replacement cost.

Many policies also include additional living expenses if your home is uninhabitable after a fire. This helps pay hotel bills, restaurant meals, and other costs above your normal living expenses while you can’t live at home. Typically policies provide coverage for up to 20% of the insured value of your home. https://www.forbes.com/advisor/homeowners-insurance/fire-insurance/

So in summary, basic homeowners insurance will pay to repair or rebuild your home, other structures, and replace belongings (up to policy limits) that are damaged by an accidental fire. It will also cover additional living expenses if you can’t stay in your home during repairs. There are some limitations though, like only covering depreciated value for personal property.

Candle Fires

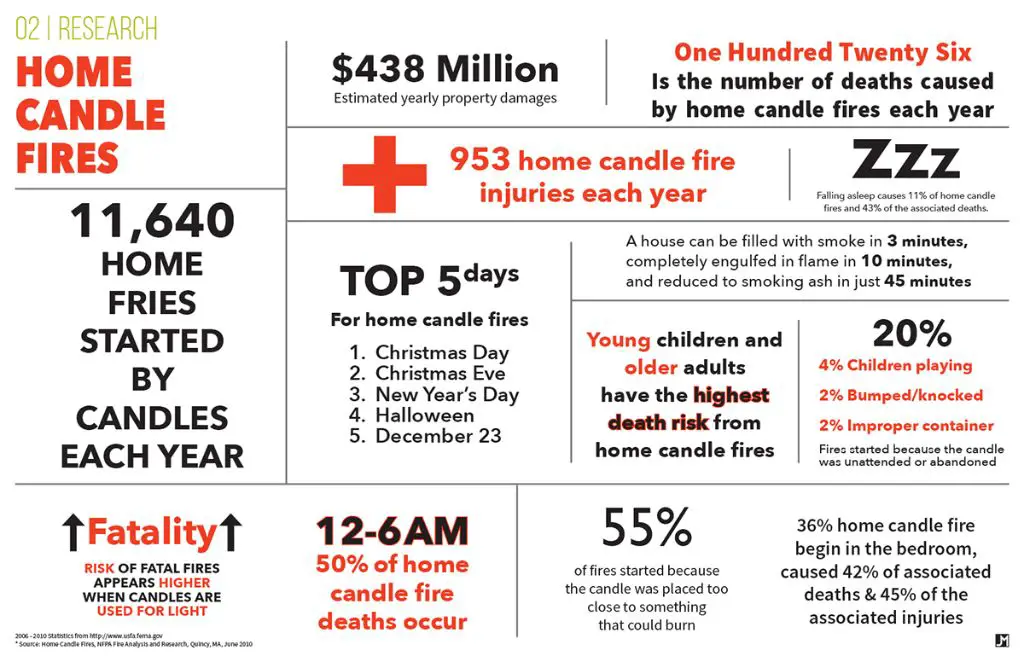

Candles are a leading cause of house fires, resulting in significant property damage as well as injuries and deaths each year. According to the U.S. Fire Administration, candles caused an estimated average of 8,900 home fires per year from 2014 to 2018, resulting in 86 deaths, 827 injuries, and $374 million in property damage annually (https://apps.usfa.fema.gov/downloads/pdf/statistics/v6i1.pdf). The National Fire Protection Association similarly found that candles were the source of 2% of reported home fires from 2011-2015 (https://www.nfpa.org/education-and-research/home-fire-safety/candles).

Candle fires often start when combustible materials are placed too close to the flame. According to the U.S. Fire Administration, 25% of home candle fires started in the bedroom, and bedding was the item first ignited in 17% of the fires (https://apps.usfa.fema.gov/downloads/pdf/statistics/v6i1.pdf). Prevention education is critical to reducing the risk of candle fires.

Negligence

Insurance policies may exclude coverage if a fire was the result of negligence by the policyholder. Negligence refers to a failure to exercise reasonable care that results in damage. For example, leaving candles unattended or too close to flammable materials could be considered negligent behavior. Most insurance policies have provisions that exclude losses caused by “intentional acts” by the policyholder. So if an insurance company can prove the policyholder was negligent and that negligence caused the fire, they may be able to deny the claim.

As one expert explains, “It’s important to remember that fire legal liability insurance may not provide protection if the policyholder is found to be grossly negligent.” However, the level of negligence required for the insurance company to deny a claim can vary. Minor negligence like briefly leaving a candle unattended may not be sufficient, while repeatedly engaging in reckless behavior like smoking in bed could potentially allow the insurer to deny coverage.

Limits and Deductibles

Even if a home insurance policy covers damage from a candle fire, policyholders will likely need to pay some costs out-of-pocket due to limits and deductibles. Most home insurance policies have coverage limits, which cap the amount the insurer will pay for certain types of claims. For example, there may be a limit of $100,000 for personal property coverage (https://www.nerdwallet.com/article/insurance/homeowners-insurance-deductible). If the damage exceeds the limit, the policyholder must cover the difference.

Deductibles also come into play with any claim. The deductible is the amount the policyholder pays toward a claim before the insurance company’s coverage kicks in. Deductibles typically range from $500 to $2,000 for home insurance, though they can be higher or lower (https://www.forbes.com/advisor/homeowners-insurance/homeowners-insurance-deductible/). With a $1,000 deductible, for example, the policyholder would pay the first $1,000 of costs from a fire claim before insurance covers any remaining expenses.

So even if a candle fire is covered, the limits and deductible mean the policyholder may still have significant out-of-pocket expenses. It’s important for homeowners to understand their policy limits and choose an appropriate deductible level when buying insurance.

Improving Coverage

There are several steps homeowners can take to improve their fire coverage and lower their premiums at the same time:

Consider getting guaranteed replacement cost coverage. This ensures the insurer will pay the full cost to rebuild your home after a covered loss, even if it exceeds the policy limits. This is important protection against underinsurance (https://www.policygenius.com/homeowners-insurance/fire-insurance/).

Install smoke detectors, fire alarms, and an automatic fire sprinkler system. Having up-to-date fire safety devices can earn you a discount on premiums (https://www.iii.org/article/12-ways-to-lower-your-homeowners-insurance-costs).

Create defensible space around your home if you live in a wildfire-prone area. This may qualify you for discounts under some insurance companies’ wildfire mitigation programs.

Consider raising your deductible. This can lower your premiums significantly. Just make sure you have enough savings to cover the higher out-of-pocket costs if a claim occurs.

Shop around and compare quotes from multiple insurers. Some may offer better fire coverage or discounts than others.

Alternatives

If you find yourself uninsured or underinsured after a candle fire, there are some options beyond traditional insurance that may provide assistance. According to Exploring Alternatives to Traditional Insurance, having an emergency fund set aside can give you more control when disaster strikes. Though it takes discipline to build up savings, even a small cushion of a few thousand dollars could help cover temporary housing, food, and basic necessities after a fire.

You may also look into assistance from charitable organizations like the Red Cross, Salvation Army, or local community groups, as noted in Resources to Use When You Don’t Have Fire Damage Insurance. These groups may be able to provide emergency shelter, food, and basic supplies in the aftermath of a house fire. Check if local churches or nonprofits offer assistance as well.

Additionally, FEMA may provide grants and low-interest loans to uninsured victims recovering from a disaster. Filing an insurance claim isn’t required to receive FEMA aid. While not a complete solution, FEMA money can help bridge the financial gap after a devastating home fire loss.

Prevention

To help prevent candle fires, it is important to never leave burning candles unattended (Fire Safety & Candles https://candles.org/fire-safety-candles/). Candles should be extinguished before leaving a room or going to sleep. It is also recommended to keep candles at least 12 inches away from anything that can catch fire, like curtains or furniture (10 Tips to Help Prevent Candle Fires in Your Home https://www.thesilverlining.com/westbendcares/blog/bid/161843/10-tips-to-help-prevent-candle-fires-in-your-home). Using candle holders that are sturdy and won’t tip over easily can help prevent accidental fires. Overall, exercising caution and close supervision when burning candles can go a long way in preventing candle-caused fires in the home.

Summary

In summary, whether or not insurance will cover damage caused by a candle fire depends on several factors:

– The type of insurance policy you have – standard home or rental insurance will typically cover candle fires, but may exclude negligence. Special endorsements may be needed for full coverage.

– Where the candle fire occurred – fires confined to the candle itself may fall under limits or deductibles and not be covered.

– How the fire started – insurance is less likely to cover damage if negligence played a role, such as leaving a candle unattended.

– Steps you took to prevent fires – having fire alarms, not exceeding burn times, using sturdy holders, etc., will strengthen your claim if a fire does occur.

While insurance can ease the financial burden, prevention is ideal. Following fire safety tips, opting for battery operated candles, using caution, and confirming your policy details are some ways to reduce candle fire risks.