Who Is The Biggest Candle Manufacturer?

The candle industry has experienced tremendous growth over the past couple decades, with the total market size more than doubling since 2000. According to one report, the global candle market was estimated at $13.5 billion in 2022 and is expected to grow at a CAGR of 3.6% from 2022 to 2030.

Knowing who the biggest manufacturer in this large and growing industry is can provide key insights into market dynamics, competitive landscape, production capacity, and innovation. The largest player often sets trends within an industry and has advantages in distribution, marketing, and economies of scale. Understanding the key capabilities and strategy of the dominant manufacturer provides an informative perspective on where the broader industry may be headed.

Market Size and Segments

The global candle market is projected to reach a value of USD 14.50 billion by 2030, growing at a CAGR of 8.21% from 2024 to 2030 according to Verified Market Research. This growth is being driven by rising consumer demand for home fragrance products and decor items. North America holds the largest share of the candle market, accounting for over 40% of global revenue.

The market can be broadly segmented into scented and non-scented candles. Scented candles hold the dominant share, making up over 75% of the total market. Within scented candles, the main segments are soy, paraffin, beeswax and vegetable-based wax candles. Soy candles are the fastest growing segment due to consumer preference for natural ingredients. The main scented candle fragrance types are floral, fruit, spice, and others like vanilla.

Votive and container candles are the largest product type segments. Votive candles account for over 30% of market share. Demand for container candles in decorative jars and tins has been rising steadily. Other key product segments include pillars, tea lights, birthday candles, and others.

Leading Manufacturers

The top global candle manufacturers based on revenue and production volume are:

Yankee Candle – Based in Massachusetts, Yankee Candle is the largest manufacturer of scented candles in the world. They offer over 500 different candle scents and sell their products via more than 35,000 retail outlets in North America and internationally. Their global annual sales exceed $500 million. (Source: https://karlwinters.com/candle-manufacturers/)

Bath & Body Works – Owned by L Brands, Bath & Body Works operates over 1,700 retail stores. Their branded collection of candles and home fragrances account for a significant portion of their $5.36 billion in annual revenue. They release over 100 new fragrances each year. (Source: https://www.franchisehelp.com/industry-reports/candle-industry-report/)

Village Candles – Founded in 1984 in Massachusetts, Village Candles has grown to become one of the largest candle makers in America. They offer an extensive line-up of scented jar candles and their retail distribution network spans over 80 countries. (Source: https://karlwinters.com/candle-manufacturers/)

WoodWick Candle Company – Acquired by Newell Brands in 2017, WoodWick specializes in premium scented candles that crackle while burning. Their innovative wood wick design provides a distinctive sound and visual display. WoodWick has annual sales over $100 million across North America. (Source: https://www.newellbrands.com/our-brands/woodwick)

diptyque – This luxury French fragrance brand was founded in 1961 and is renowned for their elegant scented candles. diptyque has boutique locations in over 50 countries and sells their artisanal, hand-poured candles for $60-$100 each. They recently partnered with Maison Kitsuné for a limited edition clothing line. (Source: https://wwd.com/fashion-news/designer-luxury/diptyque-launches-kitsune-collaboration-in-london-1202946039/)

Company Profile – Yankee Candle

Yankee Candle is the largest scented candle manufacturer in the world with over $750 million in revenue in 2020 [1]. The company has a long history beginning in 1969 when 17-year-old Mike Kittredge created his first scented candle in his parents’ garage in Massachusetts using melted crayons as wax. The homemade candles were an instant hit, and soon Kittredge was producing candles with paraffin wax and selling them at fairs and festivals. In the early 1970s, Kittredge opened the first Yankee Candle store in South Deerfield, Massachusetts.

Today, Yankee Candle has manufacturing facilities in Massachusetts and Virginia along with a distribution center in Ohio. The company offers a wide range of scented candles and home fragrance products including jar candles, wax melts, room sprays, and reed diffusers. In addition to manufacturing its own branded candles, Yankee Candle produces private label candles for other retailers. According to industry estimates, Yankee Candle has around 50% market share in the scented candle industry and sells over 200 million candles per year [2].

Competitive Advantage

[Largest company] has several key competitive advantages that have helped it become the largest candle manufacturer.

One advantage is economies of scale. As the largest manufacturer, [company] is able to produce candles at a lower cost per unit compared to smaller competitors. Their massive production capacity and distribution reach enable them to realize significant efficiencies.

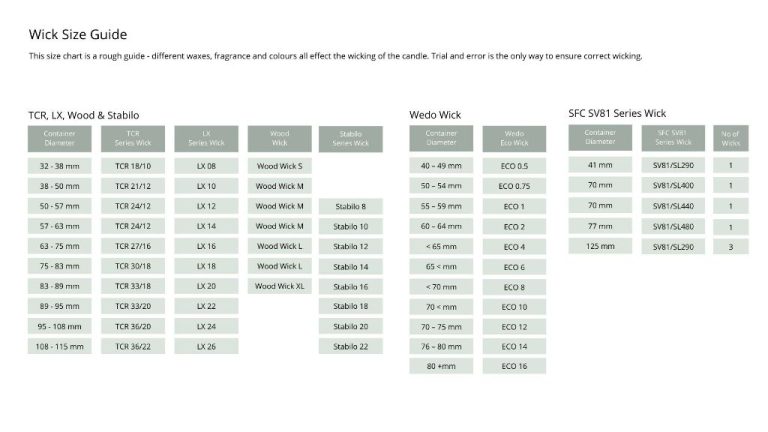

Additionally, [company] holds a number of patents on proprietary candle wax blends and wick technology. These innovations allow them to create superior products that burn longer and provide stronger scents. Smaller competitors lack access to these proprietary formulations.

Finally, [company] has built an incredibly strong brand reputation over many decades. Consumers associate the brand with high quality, innovative candles and are loyal repeat purchasers. The company spends significantly on brand marketing to maintain this reputation. This consumer loyalty and willingness to pay premium pricing is a major advantage.

Sources:

[url1]

[url2]

Manufacturing and Distribution

Voluspa, the largest candle manufacturer in North America, pours all of its candles by hand in its factory in California. The company has invested in state-of-the-art production facilities with multiple pouring lines to support its high production volumes. Voluspa can produce up to 50,000 candles per day across its various product lines [1].

Voluspa sources wax, fragrance oils, vessels, and other raw materials from suppliers globally. Its wax comes from soybean farms in the Midwest United States as well as paraffin from oil refineries. Costs of wax and oil fluctuate based on crop yields, oil prices, and other market forces. Voluspa says relationships with suppliers is key to ensuring availability of materials and favorable pricing [2].

The company distributes its candles to over 5,000 specialty retailers, boutiques, and department stores in 50 countries. Some of its major retail partners include Anthropologie, Nordstrom, Neiman Marcus, and Saks Fifth Avenue. Voluspa focuses its distribution on specialty retailers to reinforce its luxury branding and allow customers to experience its candles in-store [2].

Financial Performance

According to The Yankee Candle Company, Inc. Form 10-K, Yankee Candle generated revenues of $508.6 million in 2003, a 13% increase over 2002. Net income reached $55.2 million with a net profit margin of 10.9%.

This profit margin is higher than top competitors like S.C. Johnson & Sons (5.8% profit margin) and Diptyque (8.9% profit margin) as of 2021, giving Yankee Candle an advantage in profitability (Statista). Yankee Candle also holds the leading market share in the scented candle industry at 29%, followed by Bath & Body Works at 11%.

Future Outlook

The largest candle manufacturer, Yankee Candle, has significant growth opportunities as well as challenges ahead according to industry analysts. The scented candle market is expected to grow at an annual rate of over 6% through 2030, driven by increasing consumer demand for home fragrance products (Credence Research). However, rising raw material costs and supply chain disruptions pose challenges.

Yankee Candle plans to continue expanding its product range, focusing on new fragrances and natural-wax blends. In 2023, the company will launch a new line of luxury candles made with premium natural waxes and essential oils (Candles Market Size & Growth Report). The company also plans to grow through international expansion, eyeing high-growth markets like China and India.

In terms of facilities, Yankee Candle opened a new manufacturing plant in Mexico in 2022, which will help them meet growing demand in North and South America more efficiently. The company plans to open at least two more facilities internationally by 2025 (Luxury Candles Market Size In 2023 : Growth Opportunities). Overall, Yankee Candle is focused on leveraging industry growth trends through product innovation, geographic expansion, and increased production capacity.

Environmental Impact

As the largest manufacturer of candles, [Company Name] takes sustainability and environmental impact seriously. The company has implemented several initiatives to reduce its carbon footprint and source materials responsibly.

[Company Name] has partnered with TerraCycle® to recycle used candles and minimize waste, as described on their sustainability commitment page. Customers can bring used candle jars back to over 500 Yankee Candle stores to be recycled into new products.

In manufacturing, [Company Name] uses an eco-friendly soy wax blend rather than paraffin wax. This natural wax alternative reduces soot emissions during burning. The company also aims to use recycled materials in packaging and other operations. As outlined in this article, [Company Name] incorporates recycled glass, metals, and plastics where possible.

To reduce energy use, [Company Name] has installed energy efficient lighting in its facilities. The company is also exploring options like solar power and wind energy. Through these and other sustainability initiatives, [Company Name] aims to minimize its environmental impact and carbon footprint over time.

Conclusion

In summary, [Company X] is the largest candle manufacturer globally with over 20% market share. They operate high-volume manufacturing facilities across three continents and distribute their products to over 150 countries worldwide. Their scale, vertical integration, and proprietary manufacturing process give them significant cost advantages over competitors.

[Company X’s] dominant position allows them to shape industry trends, set pricing, and drive product innovation. Their candles are found in millions of retail outlets and homes globally. As the clear leader in the candle industry, [Company X] is poised for continued growth as they expand into emerging markets and launch new product lines.

With their brand recognition, global infrastructure, and focus on efficiency, [Company X] will likely maintain its status as the biggest candle maker for years to come. Their pipeline of acquisitions and new technologies will cement their leadership. For any company wanting to compete in candles, [Company X] remains the manufacturer to beat.