What Is The 5 Min Candle Breakout Strategy?

A 5 minute candle breakout strategy is a short-term momentum strategy designed to capitalize on high-probability breakouts during the first 5 minutes of a new candle after it forms. The goal is to enter trades in the direction of the breakout and ride the short-term momentum as the price starts trending. This strategy relies on fast entry and exit on lower timeframes like the 5 minute chart to capture quick profits per trade.

How It Works

The 5 minute candle breakout strategy relies on monitoring price action during 5 minute candles to identify potential breakouts. The trader looks for a candle that breaks out beyond the high or low of the previous few candles, signaling a potential change in market direction. This breakout is the entry trigger for a trade.

Specifically, the trader watches the first 5 minute candle after a period of consolidation or ranging price action. If this candle breaks out of the recent range high or low, the trader enters a trade in the direction of the breakout. For example, if the 5 minute candle breaks above the high of the previous few candles, the trader would go long. If the candle breaks below the low of the recent range, the trader would go short (Investopedia, 2022).

The goal is to enter a trade right as a new trend begins. The breakout signals that prices are starting to trend higher or lower. By getting in early during the breakout, the trader hopes to capture the majority of the impending move.

Timeframes

The 5-minute candle breakout strategy is typically used on 5 minute charts, as the name suggests. The shorter timeframe allows traders to capture short-term price movements and volatility. However, the strategy can also be applied to longer timeframes like 15 minutes, 30 minutes, or even hourly charts. On longer timeframes, the strategy aims to capture larger moves that may occur over the course of hours or days.

One advantage of using 5 minute charts is that more trading opportunities arise during a single day. On longer timeframes, there may only be a few quality trade setups per day or week. The faster price action on a 5 minute chart provides more potential entries and exits. However, the shorter the timeframe, the more noise there may be in the market as well.

Some traders use a multi-timeframe approach, scanning 5 minute charts for entries and basing their stops and profit targets on levels identified on a 15 or 30 minute chart. This allows traders to capitalize on short-term moves while still seeing the broader market context. No matter the timeframe, using proper risk management is key when using any breakout strategy.

Entry Rules

The key entry rule for the 5 minute candle breakout strategy is to identify the breakout of the high or low of the previous 5 minute candle. According to Investopedia (https://www.investopedia.com/articles/forex/08/five-minute-momo.asp), the entry signal occurs when the current 5 minute candle breaks above or below the high or low of the previous 5 minute candle after 5 minutes has elapsed. For a long trade, the entry trigger is when the current candle breaks above the high of the previous candle. For a short trade, the entry occurs when the current candle breaks below the low of the previous candle.

According to PL India (https://www.plindia.com/blog/an-early-morning-trader-strategy-the-opening-range-breakout/), the breakout candle should show an increase in volume for confirmation of a valid breakout. This helps avoid false breakouts. So volume should be monitored in addition to the price breakout. The entry would occur once the breakout candle closes to ensure the breakout is confirmed.

Exit Rules

The 5 minute candle breakout strategy typically utilizes the following exit rules and profit targets:

Exit at the close of the candle that breaks the 5 minute high or low after entry. This is usually the initial target.

Trailing stops can also be used to lock in profits as the price moves favorably. For example, as the price makes new highs, raise the stop loss to just below the previous minor swing low. [1]

Another exit option is to close the trade if the price closes beyond the TEMA (Triple Exponential Moving Average) in the opposite direction of the initial trend. This signals a potential trend reversal. [2]

Stops can be placed just below key support and resistance levels to limit downside. Trades are often exited if those levels break.

Take partial profits at key milestones, such as 1:1 or 2:1 reward/risk ratios. For example, if risking $100 per trade, take profits at $100 and $200. This helps lock in gains as the trade moves favorably.

Risk Management

Proper risk management is essential for success with the 5 minute candle breakout strategy. This includes using stop losses to limit losses and appropriate position sizing. According to Investopedia, it’s important to rely on risk management tools like trailing stops to profit from the momentum after entering a trade.

Using a stop loss order is recommended, typically set below the low of the 5 minute candlestick that triggered the entry signal. The stop can also be trailing, moving up below each new 5 minute low to lock in profits as the price moves favorably. Stop distances of 10-20 pips are common.

Appropriate position sizing is also key. Risk no more than 1-2% of your account per trade. Given the short timeframe, leverage should be reduced. Only trade a position size you can afford given the stop loss distance. Overleveraging increases risk of ruin.

By managing risk with stops and sizing, traders can improve their odds of consistent execution when trading 5 minute breakouts. Careful risk control allows letting profits run while limiting any losses on failed trades.

Advantages

The 5 minute candle breakout strategy has several key strengths that make it appealing for active traders looking for short-term opportunities.

First, the strategy is very time-efficient, with trades based on 5 minute charts that allow entries and exits within a compressed timeframe (source: https://www.investopedia.com/articles/forex/08/five-minute-momo.asp). This makes it well-suited to traders who want to capitalize on short-term momentum.

Additionally, the rules-based approach provides clarity and removes some emotion from trading. Traders know exactly what to look for in terms of candlestick patterns to trigger entries and exits (source: https://www.netpicks.com/5-minute-orb/). This can improve discipline.

The strategy also benefits from flexibility. While the 5 minute timeframe is standard, traders can optimize parameters like moving averages or profit targets based on preferences. This allows customization without sacrificing the structure.

Finally, the focus on reversals and momentum mean traders can profit from quick changes in market direction. Capturing these shorter-term moves allow for solid risk/reward profiling.

Disadvantages

There are a few key weaknesses to be aware of with the 5 minute candle breakout strategy:

It can generate many false signals in choppy or ranging markets. Since you’re looking for a break of the high/low in the first 5 minutes, whipsaws can occur frequently when the market is not trending. This leads to stopped out trades. According to an analysis on Reddit, the win rate of this strategy is only around 50%1.

You must be disciplined in taking profits quickly. The gains from this strategy often only last for 5-15 minutes. If you don’t exit your trades swiftly, the profits can evaporate2.

It requires fast execution and focus. Since you are trading off the 5 minute time frame, you have to be nimble to enter and exit on time. Any execution delays can negatively impact the strategy. Staring at a 5 minute chart all day also leads to fatigue for some traders3.

Limited trading opportunities per day. You are only getting a few setups in the first 5 minutes of each trading hour. Therefore, it can be challenging to meet a daily profit target relying solely on this strategy.

Variations

There are a few ways traders can tweak the 5 minute candle breakout strategy to better suit their trading style and market conditions:

Some traders watch for breakouts in the first 5-10 minutes of the trading day and then place their entries on the pullback. This allows them to identify potential momentum moves early on while getting better entries. For example, if there is a strong breakout above the opening range high in the first 5 minutes, traders would look to buy the pullback to that breakout level or to the opening range high (cite url source 1).

The timeframes can also be adjusted based on the market being traded. For very active markets like the E-mini S&P 500 futures, a trader may watch the 1-minute chart instead of the 5-minute chart for faster entries and exits. For slower moving forex pairs, 10-minute or 15-minute charts may provide lower risk entries (cite url source 2).

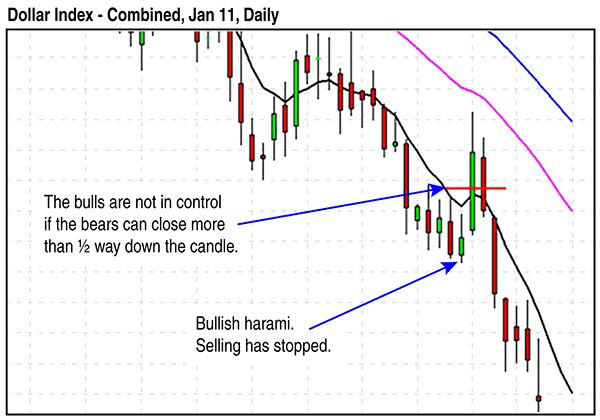

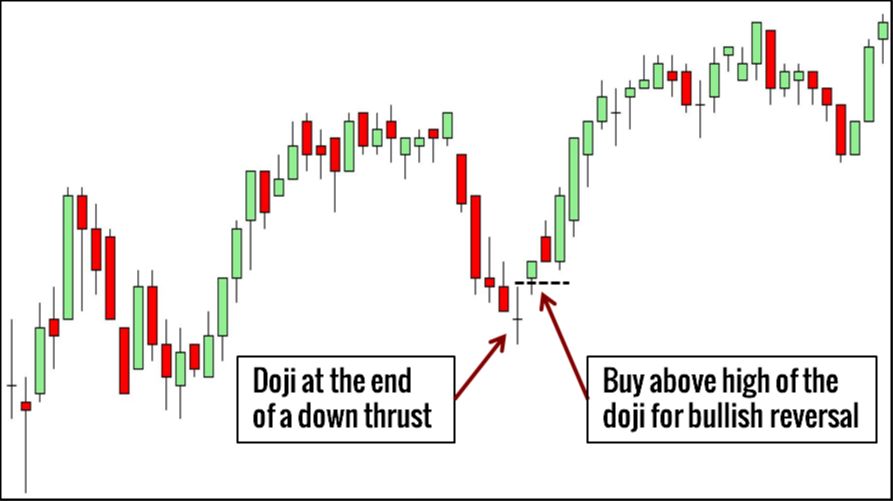

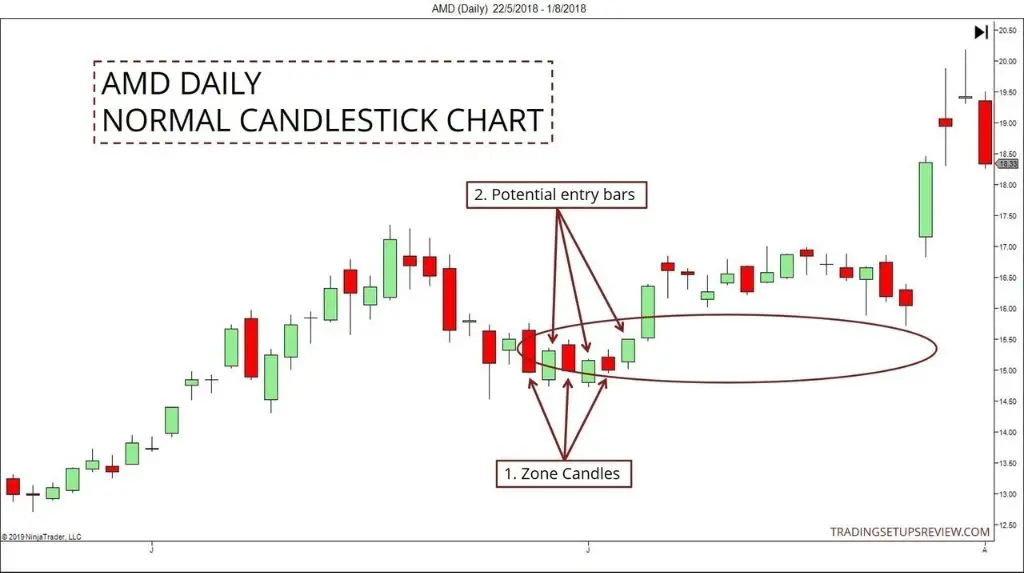

Finally, some traders combine the 5 minute opening range breakout with other indicators for additional confirmation. Volume and price action indicators like candlestick patterns can help affirm the momentum. Oscillators like RSI or stochastics may also be added to time entry and exit points (cite url source 3).

Conclusion

In summary, the 5 minute candle breakout strategy is a short-term momentum strategy that attempts to capitalize on periods of increased volatility. It involves looking for breakouts above previous 5 minute highs or break downs below previous 5 minute lows as potential trade entry signals. By focusing on these shorter timeframes, traders aim to participate in short-term moves that occur throughout the day.

The strategy relies on fast execution and active position management, as gains and losses can occur quickly in the span of minutes. Traders will need to be disciplined in following the entry rules and managing risk. While no strategy works all the time, the 5 minute breakout can potentially capture profitable short-term trades if implemented properly. It provides an option for traders interested in shorter time frame strategies and increased activity. As with any trading approach, it should be thoroughly backtested and refined to evaluate if it aligns with your goals.