What Is A Burn Multiplier?

What is a Burn Multiplier?

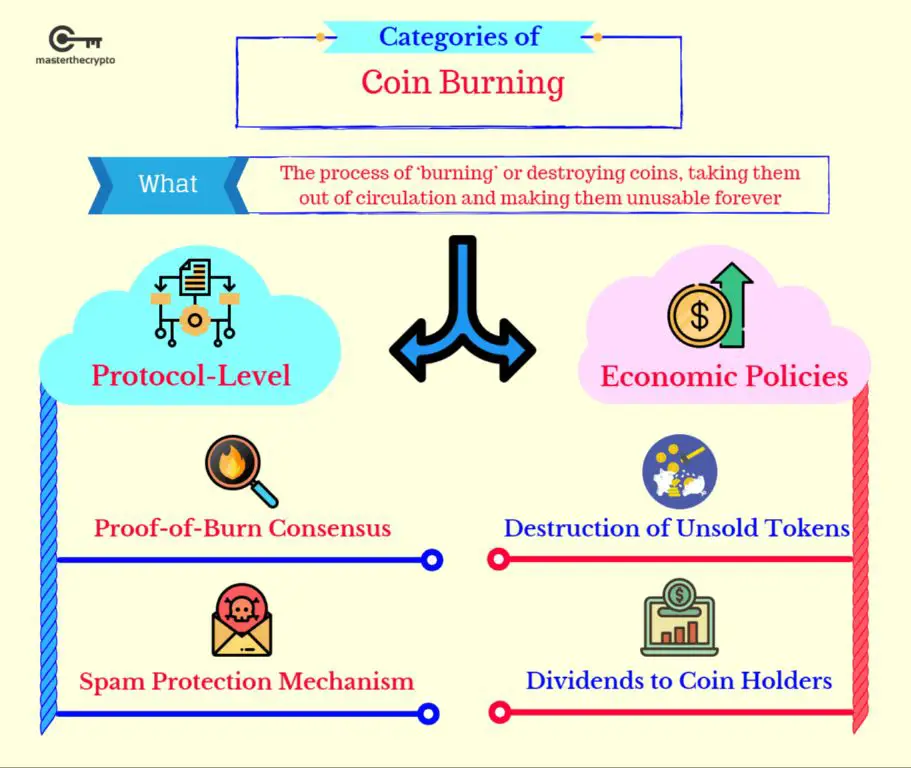

A burn multiplier is a mechanism used in cryptocurrencies and blockchain networks to perpetually reduce the total supply of tokens over time. It works by permanently removing or “burning” a percentage of tokens from circulation whenever a transaction occurs.

When a transaction happens, a portion of the fees are diverted to a burn wallet or address that no one has access to. These tokens are effectively eliminated from the circulating supply. The percentage of tokens burned with each transaction is determined by the burn multiplier.

For example, a 2% burn multiplier would mean 2% of the transaction fees are burned each time. As more transactions occur on the network, more tokens are continuously burned, resulting in deflationary pressure on the total supply.

Burn multipliers are important for cryptocurrencies because they create a deflationary tokenomics model. As the supply decreases over time while demand increases, the value of each remaining token goes up. This encourages holding, provides upside potential, and counteracts inflationary pressures.

In addition, the transparency and autonomous nature of burning through multipliers establishes predictable deflation rates. This helps build trust and make the cryptocurrency more appealing to investors in the long run.

How Burn Multipliers Increase Value

Burning cryptocurrency tokens reduces the total supply and increases scarcity. By reducing the number of tokens in circulation, each remaining token becomes more rare. This can stimulate demand as people anticipate the increased scarcity leading to gains in value per token. With more demand chasing fewer tokens, the laws of supply and demand suggest the price per token should rise.

Increased demand paired with decreased supply is a recipe for increasing value. There are many examples of cryptocurrencies using burn multipliers to reduce supply and drive up value. Coins like Binance Coin, Ethereum, and SafeMoon have all utilized burns to varying degrees of success. The transparency of public blockchains allows investors to analyze historic burns and model the impacts on circulating supply and value.

Popular Cryptocurrencies Using Burning

Several major cryptocurrencies utilize burn mechanisms to reduce token supply and potentially increase value over time. Here are some of the most notable examples:

Ethereum – Ethereum has implemented a fee burning mechanism as part of its EIP-1559 upgrade in August 2021. A portion of fees paid to validate transactions on Ethereum are now permanently destroyed or “burned”. As of February 2024, over 2.5 million ETH worth around $3.5 billion has been burned (https://etherscan.io/chart/ethersupply).

Binance Coin – BNB utilizes a quarterly burn based on trading volume on their Binance exchange. Since launching in 2017, Binance has burned over 1.2 million BNB worth around $1.8 billion at current prices (https://www.binance.com/en/blog/421499824684901157/binance-completes-23rd-quarterly-bnb-burn).

FTT – The FTX exchange token FTT burns tokens based on trading fees collected by the exchange. Over $60 million worth of FTT has been burned since 2019 (https://ftx.com/en/ftt).

Burning Mechanisms

There are several common mechanisms used to burn cryptocurrency tokens:

Transaction Fees – Some protocols burn a percentage of the transaction fees on their network. These transaction fee burns occur automatically on an ongoing basis. For example, the Ethereum network burns a portion of gas fees with each transaction (Source: https://www.investopedia.com/tech/cryptocurrency-burning-can-it-manage-inflation/).

Automatic Periodic Burning – Some projects have programmed periodic burns into their tokenomics. On scheduled intervals, a certain percentage of the circulating supply is automatically removed from circulation. This creates predictable deflation while rewarding holders (Source: https://builtin.com/cryptocurrency/what-does-burning-crypto-mean).

Manual Burning – Developers or foundations may conduct manual token burns periodically. These burns are initiated manually, giving the project more control over the timing and amount burned. Manual burns can build hype and increase scarcity during strategic times (Source: https://www.linkedin.com/pulse/staking-earning-burning-altcoin-mechanisms-fueling-market-recovery-fw5dc).

In summary, cryptocurrency projects utilize transaction fees, automatic scheduled burns, or manual burns to permanently remove tokens from circulation. This creates scarcity and deflationary pressure on the token supply.

Burn Multipliers vs Fixed Burning

There are two main approaches to burning cryptocurrency tokens – using a variable burn multiplier or a fixed burn rate. With a variable burn multiplier, the percentage of tokens burned increases or decreases based on certain factors like market conditions. For example, a protocol may burn 1% of tokens when the price is below a target threshold, but 5% when above the target. This aims to stabilize the token price by burning more when prices are high and less when low. The burn multiplier adjusts dynamically based on market forces.

In contrast, a fixed burn rate removes a set percentage of tokens from circulation on an ongoing basis regardless of external factors. For instance, a fixed 3% burn rate would destroy 3% of the total supply every year. The rate never fluctuates.

Variable burn multipliers allow for greater flexibility and responsiveness to market conditions, potentially keeping token prices more stable. However, the complexity and opacity around changing burn rates may reduce transparency. Fixed burn rates provide consistency and transparency, but lack the dynamic adjustments of multipliers.

Overall, variable burn multipliers aim to tightly control token supplies using economic levers, while fixed rates follow a simple, predictable path of gradual deflation. The two approaches offer distinct benefits and drawbacks that suit different goals and philosophies around crypto token burning.

Importance of Transparency

Cryptocurrencies thrive on trust, and transparency is critical for building that trust between projects and their communities. When it comes to burning crypto tokens, transparency ensures that the burning occurs as claimed by the project teams. The open and immutable nature of blockchains enables this transparency around burning.

Investors want to verify that the promised amount of coins are actually being burned. They need to see clear evidence on the blockchain that the burns have taken place. Otherwise, there could be accusations that the project team is misrepresenting the truth. According to one analysis, “Transparency means complete visibility into trading operations, fees, and processes. For traders, it ensures: Informed Decision Making: Clear information helps traders make wise choices” (Source). Without transparency around burning, traders cannot make fully informed decisions.

The trust of crypto communities depends on projects being honest and transparent about the planned burning mechanisms and amounts. Blockchain’s transparency supports this by letting investors verify that burns occur as promised.

Criticisms and Downsides of Burning Crypto

While crypto burning mechanisms aim to increase scarcity and value, the approach also faces criticisms and potential downsides.

One risk is the possibility of creating deflationary spirals, where reducing supply leads to runaway appreciation. This could incentivize hoarding and discourage economic activity, as happened historically during the Great Depression.

Critics also argue burning concentrates crypto wealth, as holders gain from appreciation while circulating supply decreases. According to CNBC, this contributes to the divide between haves and have-nots.

Additionally, some view burning as artificial inflation, since it relies on hype and psychology more than underlying utility or adoption. Trust suffers if projects burn simply for speculative gain.

Thus, while burning offers benefits, implementers should also consider deflationary risks, wealth divides, transparency, and maintaining organic value beyond just reduced token counts.

Regulatory Considerations

The Securities and Exchange Commission (SEC) is an agency focused on protecting investors in securities markets and regulating financial institutions. As cryptocurrencies have gained popularity, the SEC has had to determine how existing securities regulations may apply. One consideration around burning crypto tokens is whether it constitutes a return to investors, and would therefore classify the crypto as a security.

According to a paper by researchers at the National Bureau of Economic Research Cryptic Regulation of Crypto-Tokens, burning mechanisms are one aspect the SEC examines to determine if a cryptocurrency is a security or not. If burning crypto is seen as similar to stock buybacks or dividends which provide a return to shareholders, it could lead to stricter regulations. The SEC has provided some guidance, but the regulatory treatment of burning cryptocurrency is still an evolving area.

From a tax perspective, burning crypto also introduces complexities. In some cases, burned tokens are treated as being sold for $0, which could be a taxable event. The timing and calculation of gains on burned crypto varies across jurisdictions. Protocols looking to implement burning need to consider the tax implications for users. As cryptocurrency regulations develop globally, more clear guidelines around the tax treatment of burning tokens may emerge.

Future Outlook

The future looks bright for increased adoption of burning mechanisms in cryptocurrencies. According to analysts, the multiplier effect from token burning has proven successful for boosting valuations and attracting investor interest (Thomas Young’s analysis predicts a significant Bitcoin will rise to $131,000, driven by ETF inflows and the 118 Multiplier concept. Feb 9, 2024 — Thomas Young’s analysis predicts a significant Bitcoin will rise to $131,000, driven by ETF inflows and the 118 Multiplier concept. [1]). As more cryptocurrencies implement burning, we can expect heightened interest and rapid growth in projects utilizing this mechanism.

Burning is also likely to evolve and take new forms as the industry matures. Some potential innovations include randomized burning based on various on-chain factors, burning tied to platform usage metrics, and community-driven burning through governance votes. Cryptocurrencies will compete to create the most effective and transparent burning models to lure investors. Regulators may also begin to provide frameworks for implementing burns responsibly. Overall, the next few years should see burning solidify as an essential tool for building value and stability in cryptocurrencies.

[1] https://www.ccn.com/analysis/bitcoin-to-131000-thomas-young-118-multiplier-2024-forecast/

Conclusion

This article explained the concept of a burn multiplier and how it leads to an increased value of cryptocurrencies.

To recap key points: Burning refers to sending coins to unspendable addresses to remove them from circulation. A burn multiplier does this at an increasing rate as the number of coins goes down. This creates deflation and can make the remaining coins more valuable over time.

Burning mechanisms are designed to improve the sustainability and long-term value of cryptocurrencies. They incentivize holding and reduce circulating supply. But transparency and moderation are key – communities should be informed on the specific burning model and rate.

While burning can potentially increase value, it also carries criticisms such as environmental concerns, centralization risks, and market manipulation. Proper regulations will need to balance innovation and responsible practices.

Looking ahead, burning is likely to remain an important strategy for many cryptocurrencies. The long-term impacts will become clearer as projects experiment and refine their approaches. When implemented ethically, burning can be a valuable tool for building sustainability.