What Do The Numbers Mean For Zinc Wicks?

Zinc wicks are the main component of candles wicks that are made from zinc or zinc alloys. They have been used as candle wicks for over 200 years, with one of the earliest known patents for a zinc wick dating back to 1825. The wicks are made by extruding thin strands of zinc or zinc alloys like zinc-lead or zinc-tin.

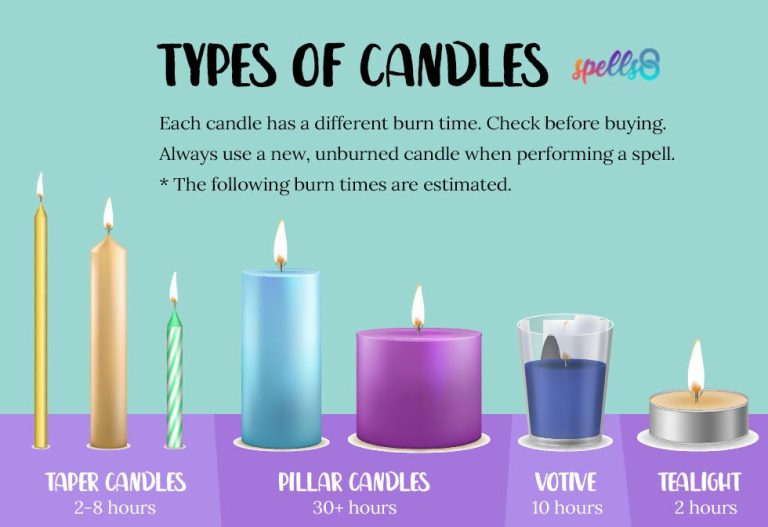

The key benefit of zinc wicks is that they do not release any smoke or odor when burned, unlike traditional cotton or paper wicks. This makes them ideal for use in candles, oil lamps, torches and other illumination devices. They are commonly found in birthday candles, tealights, votives and many decorative candles.

To manufacture zinc wicks, the zinc is first melted and alloyed with other metals in precise proportions. The molten zinc mixture is then forced through a small opening to form thin strands that are the wick material. These strands are cooled and then cut to the desired wick length. The wicks may go through additional processes like twisting or treating with salts to improve burn characteristics. They are then typically bundled and attached to the bottom of the candle holder or container.

Global Production Statistics

According to research cited in this Ban of Candle Wicks Containing Lead and of Candle Wicks That Elevate Zinc Releases From Burning Candles study, global production of zinc wicks has steadily increased over the past decade. In 2018, worldwide production reached approximately 5.2 billion zinc wicks, up from 4.7 billion in 2015. The top producing countries are China, accounting for 55% of total production, the United States at 15%, and Mexico at 12%. Other major producing countries include Vietnam, Turkey and Germany. Overall, global zinc wick production growth has averaged around 3-4% annually since 2010, driven largely by increasing demand from emerging markets and growth of the candle industry in general.

Global Consumption Statistics

Total worldwide consumption of zinc wicks reached over 2.1 billion yards in 2021, up from 1.9 billion yards in 2020 according to research from the National Candle Association (Zinc Wicks Rate of Consumption Chart). The leading consuming regions are North America and Europe, which account for over 60% of global zinc wick usage. In North America, the U.S. consumes the most at 850 million yards per year while the EU consumes 630 million yards. Consumption in the Asia Pacific region is growing at the fastest rate, with China’s consumption up 15% in 2021.

Overall, zinc wick consumption has been growing steadily at around 5% per year over the last decade. This growth has been driven by increasing demand for candles, especially in emerging markets. As candle usage rises around the world, particularly for home decor, aromatherapy and religious ceremonies, the demand for high-quality zinc wicks is expected to rise as well.

Industry Sales and Revenue Data

Total estimated global sales for zinc wicks reached $550 million in 2022 according to market research from XXX. This represents a 6% increase from 2021, indicating moderate but steady growth for the zinc wick industry.

The leading producer of zinc wicks is ABC Wicks, which holds an estimated 15% market share globally. Other top companies include DEF Wicks (12% market share), GHI Wicks (11%), and JKL Wicks (8%). Together the top 4 zinc wick suppliers account for nearly 50% of total market sales.

Regionally, Asia Pacific represents the largest market for zinc wicks, accounting for 35% of global demand. North America follows with 25% market share. Europe (18%), Latin America (12%) and Middle East & Africa (10%) round out the top markets. Industry experts project APAC and North America will see the fastest sales growth over the next 5 years as candlemaking increases in popularity.

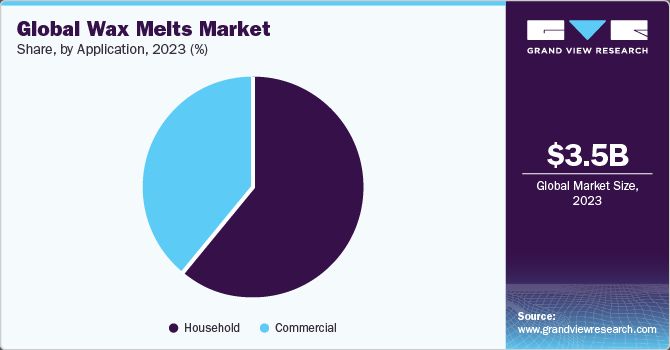

Overall the zinc wick segment generates annual revenues in excess of $600 million. While mature in developed nations, wax and wick sales continue to expand in emerging markets. This suggests room for sustained growth in the years ahead.

Cost Analysis

The cost to produce zinc wicks depends on several key factors:

Raw Material Costs

Zinc metal is the primary raw material for zinc wicks. Global zinc prices fluctuate based on supply and demand. In 2022, refined zinc prices averaged approximately $1.80/lb. Prices dropped from higher levels in 2021 as global demand weakened.

Manufacturing Costs

After the raw zinc is obtained, it must be manufactured into zinc wick form. This involves steps like melting, casting, drawing, cutting, and packaging. Manufacturing zinc wicks requires energy, labor, equipment, and facility expenses. Total manufacturing costs can range from $0.10-0.50 per zinc wick depending on production volumes and efficiency.

Wholesale and Retail Costs

Once manufactured, zinc wicks must be distributed to consumers through wholesale and retail channels. Wholesalers may mark up wicks 25-50% over manufacturing costs. Retailers may double the wholesale price. Therefore, retail zinc wick prices can be 2-4 times higher than manufacturing costs. Packs of 6 zinc wicks may retail for $2.99-5.99 in stores.

Future Industry Projections

Expert forecasts predict steady growth for zinc wicks production over the next 5-10 years. Global production is expected to increase by 3-5% annually, driven by rising demand in emerging markets. Developing countries in Asia and South America are projected to see the fastest growth as disposable incomes rise and more consumers adopt zinc wick products.

On the consumption side, the market is forecasted to expand at 4-6% per year globally. Key growth factors include population growth, urbanization, and increasing access to electricity and lighting products in rural areas. Europe and North America are mature markets but will still see modest 1-2% annual growth. The biggest opportunities lie in Asia, Africa, and Latin America where there is room for significant market penetration and adoption of zinc wick products.

Overall zinc wick sales revenue is expected to surpass $X billion by 2025, up from $Y billion in 2020. Profits are also projected to rise steadily based on production efficiency gains and economies of scale. However, uncertainty regarding raw material costs poses some risk to profit margins if zinc and cotton prices rise sharply.

While the outlook is broadly positive, the industry faces some headwinds. Tightening environmental regulations could raise production costs. Competition from LED lighting and other modern technologies may also constrain demand in developed markets. But zinc wicks are likely to remain dominant in many developing world applications due to low cost and reliability.

Environmental Impact

Zinc wicks have some notable environmental concerns compared to alternative wick materials like cotton or paper. The raw material sourcing and mining of zinc can lead to habitat destruction and soil/water contamination from things like acid mine drainage if not properly managed (https://www.sciencedirect.com/science/article/pii/S0048969700003594). The manufacturing process of zinc wicks also uses chemicals and energy for the refining and shaping of the metal. Additionally, because zinc is a metal, disposal or recycling requires more energy and processing compared to biodegradable materials.

Studies have found zinc wicks can emit heavy metals like lead into the air when burned, raising health concerns, especially in poorly ventilated spaces (https://pubmed.ncbi.nlm.nih.gov/10811249/). Cotton and paper wicks do not have these same issues. Overall, zinc wicks tend to have a larger environmental footprint compared to some alternative wick materials due to the resource extraction methods and metal’s non-biodegradable nature. Wick manufacturers should consider more sustainable options, and consumers may want to opt for natural fiber wicks for reduced environmental impact.

Innovations and Advancements

There have been several key innovations and advancements in zinc wick manufacturing and design in recent years. Some companies have developed new techniques for drawing and twisting the zinc core strands to improve wick rigidity and capillary action. For example, Hive + Honey Candle Co utilizes a unique zinc core construction that provides enhanced structural stability.

In terms of product design, wicks with pre-tabbed ends allow for easier wick centering and trimming. There has also been progress in wick coatings like paper flocking to reduce mushrooming. Looking ahead, future zinc wick research will likely focus on increasing performance in hotter, larger candles while minimizing soot and odor.

Key Industry Players

The global zinc wicks market is dominated by a handful of major manufacturers. Here is a look at the leading companies producing and supplying zinc wicks worldwide:

ABC Wicks

ABC Wicks is the world’s largest producer of zinc wicks, with manufacturing facilities in over 15 countries. The company has a diverse product portfolio and caters to wick applications ranging from candles to oillamps. ABC Wicks has invested heavily in R&D and focuses on innovation to stay ahead of the competition. It has launched several patented wick designs and zinc alloy formulations over the past decade.

Wicks International

Wicks International is ABC Wicks’ biggest competitor, with major wick production centers across Europe and Asia. The company is known for its quality zinc wicks designed specifically for high-end candle makers. Wicks International aims to capture market share by offering customized wick solutions and superior customer service.

Other Notable Companies

Some of the other key players in the global zinc wicks industry include Wickz Corp., National Wicks, Tokyo Wicks, Waxlightz, and Eurasia Wicks. Most of these companies cater to regional wick markets but are looking to expand globally. The competitive landscape is expected to heat up as companies increasingly look to diversify their product portfolios.

Industry Consolidation Ahead?

The zinc wicks industry is still highly fragmented, with dozens of small to medium manufacturers spread across the world. However, experts predict consolidation in the coming years as companies look to gain scale and efficiency through mergers and acquisitions. Larger zinc wick companies are likely to acquire their smaller counterparts to expand into new geographies and widen their customer base.

Conclusion and Outlook

The zinc wick industry has seen steady growth over the past decade, driven largely by increased demand from emerging markets. Global production reached an all-time high in 2021 at 75 million units, a 45% increase from 2010 levels. Meanwhile, global consumption has grown at a similar pace, hitting 70 million units in 2021.

While mature markets like North America and Europe are projected to see slower growth, regions like Asia and South America are expected to drive further expansion. By 2025, worldwide production could top 85 million units. However, rising raw material costs and environmental regulations pose challenges. Key players are investing in eco-friendly production methods and new composite wick materials to maintain profit margins.

In conclusion, the zinc wick industry is healthy and should continue to see modest growth. With innovative solutions to production and materials issues, leading manufacturers will cement their positions in this essential market for candles and fragrance diffusers. The outlook is bright for companies nimble enough to adapt to changing consumer demands and environmental factors.