Do You Need Insurance For A Candle Business?

Owning and operating a candle business comes with certain risks and liabilities. As a candle maker, it’s important to understand the different types of insurance coverage available to help protect your business. This article provides an overview of the main insurance policies a candle making business may need.

Candle making involves working with open flames, hot wax, and fragrances, which can lead to potential injuries, property damage, or product liability claims. Accidents at craft fairs or during delivery could also occur. Therefore, having proper insurance helps cover unforeseen costs should something happen.

The major types of insurance a candle business owner should consider include product liability, general liability, property, business owner’s policy, workers’ compensation, commercial auto, and business interruption insurance. Cyber insurance may also be recommended. This article explores each policy in detail.

Product Liability Insurance

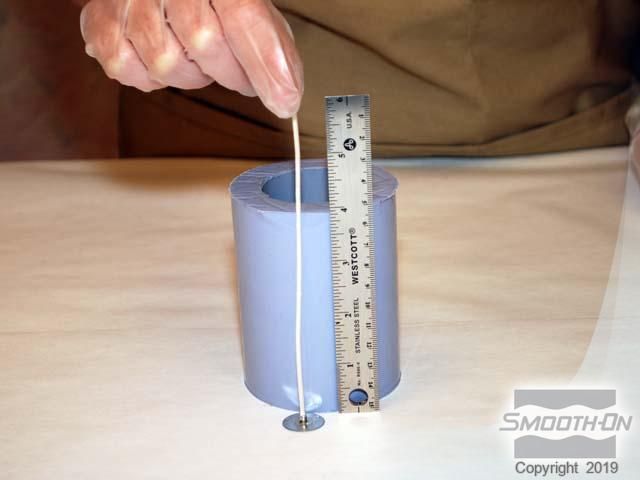

Product liability insurance is an important coverage for candle businesses to protect against claims involving injury or damage from defective products. Since candles have an inherent fire risk, product liability insurance provides protection in case a candle is determined to be defective and causes property damage or bodily injury to the end user.

According to the Insurance Information Institute, product liability claim costs have been rising recently, with over $2.4 billion in claims paid out in 2016 (III). With the flammable nature of candles, defects could lead to significant damages that product liability insurance would cover. This makes it an essential policy for candle makers and sellers.

Products like candles can be considered defective due to manufacturing flaws, design defects, or insufficient safety warnings or instructions. If any of these deficiencies causes bodily injury or property damage, the candle maker or seller may be legally responsible. Product liability insurance protects against the costs of defending against such claims and paying for damages.

Having adequate product liability limits is important to fully cover potential candle risks. Work with an insurance agent or broker to determine appropriate limits based on your business’s size and sales volume. This coverage provides an important layer of protection for candle businesses against the inherent product hazards.

General Liability Insurance

General liability insurance is essential coverage for any candle business to protect against third party bodily injury or property damage claims. As explained by Progressive Commercial in their article “Candle Making Insurance,” general liability insurance “protects your business against third-party damages and customer injuries.” 1

This type of insurance covers slip and falls, injury from store displays, or any other situation where a customer could potentially get injured while at your candle shop or market booth. For example, if a candle display falls and injures a customer, general liability insurance would cover their medical bills and protect your business from a lawsuit. According to Next Insurance in “Candle Store Insurance,” general liability is the most common and important insurance for small businesses and entrepreneurs. 2

Property Insurance

Property insurance covers damage to business property from events like fire, theft, vandalism, and more. This type of insurance protects the physical assets owned by the business such as the building, inventory, equipment, and furnishings. According to Voss Law Firm, the average cost of a single property damage claim for small businesses is around $26,000. With significant potential costs from property damage, having adequate property insurance is crucial for any small business owner.

For a candle business, property insurance would cover damage from events like fire to the building, inventory of candles/supplies, manufacturing equipment, furnishings, and more. Given candles’ flammability, having strong property insurance is especially important. According to Simply Business, the average property damage claim for small businesses is $30,000 – a significant expense that property insurance helps cover.

Business Owner’s Policy

One of the most popular insurance options for small candle businesses is a Business Owner’s Policy (BOP). A BOP packages together the key coverage types that a candle business needs into one convenient policy. This includes general liability insurance, property insurance, and business interruption insurance. According to Insureon, a BOP can be a cost-effective way for small candle shops to get coverage.

The advantage of a BOP is that it can save money compared to purchasing separate policies. Since it bundles coverage together, the premiums are usually lower overall. This makes it an appealing option for small businesses with limited budgets. The coverage limits may also be higher under a BOP compared to individual policies. This ensures sufficient protection for the various risks a candle business faces.

When shopping for a BOP policy, candle business owners should work with an agent or broker to customize the coverage and get quotes from multiple insurers. While BOPs offer convenience, it’s still important to understand what is and isn’t covered to avoid surprises in the event of a claim. But for many small candle makers and retailers, a Business Owner’s Policy offers an efficient way to get protected.

Workers’ Compensation

Workers’ compensation insurance is required by most states for candle making businesses that have employees. As per this source, workers’ compensation protects sole proprietors and candle makers from the costs associated with work injuries that employees sustain. It provides coverage for medical bills, lost wages, rehabilitation, and more. Workers’ compensation insurance helps protect the business from expensive claims and lawsuits that can arise when employees get injured on the job while making candles.

Vehicle Insurance

Vehicle insurance is needed if using company vehicles for candle deliveries (Source). This type of insurance protects against collision damage and liability claims in the event of an accident while making deliveries in a company vehicle. Commercial auto insurance covers the cost of accidents involving a candle business’s truck or other vehicle used for deliveries (Source). Most states require commercial auto insurance coverage for any vehicles owned by the business and used for commercial purposes.

Factors that affect commercial auto insurance costs for a candle business include the type and number of vehicles, mileage, location, and driving records of employees operating the vehicles (Source). Having proper commercial auto insurance ensures candle businesses are protected if anything happens during the transport and delivery of their products.

Business Interruption Insurance

Business interruption insurance replaces lost income if a covered event like a fire, storm damage, or other incident causes a candle making business to halt operations and lose revenue (source). This type of insurance covers operating expenses, helps pay employees, and reimburses income lost while the business cannot operate. For candle makers, a fire or smoke damage that forces a temporary closure of the business could lead to substantial losses without business interruption coverage.

According to one source, business interruption claims can be quite costly for candle making companies, with an average claim of $52,000 (source). Having coverage to replace lost income from being unable to make and sell candles for a period of time provides an important financial safety net. This ensures the business can cover ongoing expenses and survive the interruption to quickly resume full operations.

Cyber Insurance

As an ecommerce candle business, having cyber insurance is crucial to protect sensitive customer data in the event of a data breach. According to When You Should Consider Getting Candle Business Insurance, cyber liability insurance can provide support for crisis management and notification expenses in case you become a victim of cybercrime. It helps cover costs associated with data breaches, such as legal fees, public relations, forensic investigation services, and costs for notifying customers. Cyber insurance safeguards customer data by covering expenses needed to respond to a data breach. It provides peace of mind knowing your business is protected if hackers gain unauthorized access to customer information. With more sales happening online, cyber insurance is an important consideration for ecommerce candle businesses looking to protect sensitive customer data.

Conclusion

When starting a candle business, there are several key types of insurance to consider obtaining adequate coverage for your company. Product liability insurance helps protect you if someone is injured by your product. General liability insurance can cover any third-party bodily injury or property damage claims. Property insurance protects your business location and inventory from damage. A business owner’s policy bundles several coverages together for convenience. Workers’ compensation insurance is required in most states to cover employees in case of work-related injuries. Vehicle insurance protects any company cars or trucks. Business interruption insurance replaces lost income if you have to suspend operations for a covered reason. Cyber insurance helps respond to data breaches or digital attacks.

Having the proper insurance coverage is crucial for protecting your candle business. The specific types and amounts of insurance needed will depend on your particular operations and risks. But generally, it is wise for small business owners to consult with an insurance agent or broker to evaluate their unique situation. The right insurance protection will help minimize liability exposures and provide important financial resources to keep your company up and running if you ever encounter losses from an insured peril. With adequate coverage, you can have peace of mind knowing you did your due diligence to prepare for unforeseen events.